Artificial intelligence (AI) automation in the financial field enhances both operational risk handling and managerial decision methods. The financial industry underwent transformation with AI tools for finance because these solutions enable businesses and individuals to execute work, which includes fraud detection, credit rating operations, investment evaluation, and automated trading systems.

Financial institutions leverage integrated artificial intelligence solutions that run machine learning operations together with natural language processing abilities and predictive analytics components to generate live analytical data for helping groups decide and make professional choices.

The industry demands AI tools for modern businesses since digital transformation needs both efficient operations and simplified processes. AI technology enables financial institutions to develop AI chatbots that assist customers while detecting frauds besides optimizing asset management for improved security and improved results. This blog examines the best AI Tools for Finance that are currently active in finance by identifying their main advantages and operating approaches.

What Are AI Tools for Finance and Their Importance?

The automatic operation of financial operations and the production of vital analytical findings depend on financial organizations that utilize combined AI-powered finance platforms and software applications. These utilities enable organizations to detect fraudulent activities while conducting risk evaluations as well as performing automated customer support services and creating investment plans for core business operations. varlık recourses provided through AI-based tools supply banking institutions and financial services organizations with vital assets that boost productivity and deliver deep analytical findings.

Finance industry operations benefit from Artificial Intelligence tools for finance because these solutions unite high-speed processing with accurate results alongside vast data processing functionalities. The financial tools both prevent human errors while maintaining regulatory rules to provide customized premium financial solutions to individual clients. Organizations employing artificial intelligence analytical systems achieve better economic change prediction through detected market patterns to boost their financial competitiveness.

Key Benefits of AI Tools for Finance

- Automation of Repetitive Tasks– AI tools for finance enable basic human tasks to run automatically after collecting data, preparing reports, and performing reconciliation tasks, which creates operational improvements.

- Enhanced Fraud Detection– These machine learning systems, which detect unusual financial transactions along with abnormal financial activity patterns, successfully prevent fraudulent activities.

- Improved Risk Management– Leadership decisions within corporations grow more accurate because AI analyzes historical data points alongside credit scores during market trend observation processes.

- Personalized Financial Services– AI technology enables customers to benefit from personalized financial assistance, which arises when robotic advisors work with chatbots.

- Predictive Analytics– Strategic investors, along with organizations, make better operational decisions with AI-based analytical systems that generate predictions from market trends and asset performance data combined with economic volatility evaluations.

- Regulatory Compliance– Financial institutions maintain regulatory compliance through AI technology since their systems are alert about abnormal financial activities.

- Cost Reduction– A system with automatic process implementation provides financial institutions with reduced operational costs while offering precise results that boost operational effectiveness.

- Algorithmic Trading– The trading bots use machine algorithms to process market data for deciding profitable trades.

Top 10 AI Tools for Finance

1. Clearwater-GPT

Clearwater-GPT enables Clearwater Analytics to oversee funds exceeding $8.8 trillion through its intelligence-based solutions capabilities. The tool helps organizations in investment to enhance their financial operations while enabling tracking of assessment results in risk evaluation processes. Fund managers who use Clearwater-GPT automation for financial data aggregation with portfolio management boost their decision systems and minimize human interaction to establish essential assets in asset management.

Clearwater-GPT analytics delivers improved operational efficiency to banks and financial institutions that implement its artificial intelligence capabilities. Clearwater Analytics shows successful growth because its stock value has increased since market demand grows for financial software solutions using Artificial Intelligence technology. Clearwater-GPT holds a leading position in financial AI solutions through its ability to generate exact performance reports and identify market trends to enhance regulatory needs.

Key Features:

- AI-powered risk analysis and financial forecasting

- System automation allows portfolios to be managed by the system as it performs performance tracking.

- Real-time data aggregation and reporting

Best For:

- Institutional investors and asset managers

- Financial analysts requiring AI-driven insights

- Large enterprises managing multi-asset portfolios

Price: The system adapts its pricing structure to match the dimensions of the portfolio alongside the number of requested features.

2. JPMorgan’s LLM Suite

Operationally, JPMorgan Chase uses the LLM Suite AI platform to provide benefits to its 100,000 workforce. With enablement from its financial workflows, this system can integrate AI into operations to let staff members generate reports while analyzing legal papers and processing customer communications. Workplace performance rises when the solution employs automated process optimization to simplify complex operations, thus speeding up financial transaction management.

The LLM Suite of JPMorgan uses two essential competencies that enable compliance and improve assistance for users. JPMorgan uses AI technology for finance systems to enhance both strategic choices and financial system risk management operations and AI control implementation. Financial institutions use this tool because it functions as their institutional operational standard and AI innovation evaluation method.

Key Features:

- Artificial intelligence conducts financial reporting procedures as well as complies with financial compliance task requirements

- The computerized system analyzes documents through legal risk assessment to determine their dangerousness level.

- Enhanced productivity for financial professionals with generative AI

Best For:

- Large banks and financial institutions

- Compliance officers and legal teams

- The financial documentation automation system helps organizations that require this kind of service solution.

Price: Since FinChat provides services exclusively to business clients, it refrains from sharing its pricing information.

3. FinChat

FinChat uses artificial intelligence to create an investment platform through which it optimizes the process of market intelligence research and report creation to support strategic investment decisions. Hot financial data produced by machine learning tools in this product assists both institutional investors and individual trader systems. FinChat’s AI-integrated interface lets investors achieve superior investment choices because automated procedures improve both research process flow and information quality.

Due to its disruptive capacity in financial analysis operations, the billion-dollar industry funded FinChat through a $1.5 million investment from VanEck. The automated data collection system on this platform produces analytics and professional documents that established its top position in AI finance research for advanced investment management systems.

Key Features:

- The technology produces both financial statements and market pattern evaluations through artificial intelligence.

- The system conducts automated financial strategy development through its research capabilities.

- Real-time stock market insights with AI-driven data visualization

Best For:

- Individual investors and portfolio managers

- Research analysts and hedge funds

- AI Solution-seeking organizations that need investment analysis enhancement

Price: Users can access the free plan, and premium subscriptions begin at ₹3,000 per month or $35 USD.

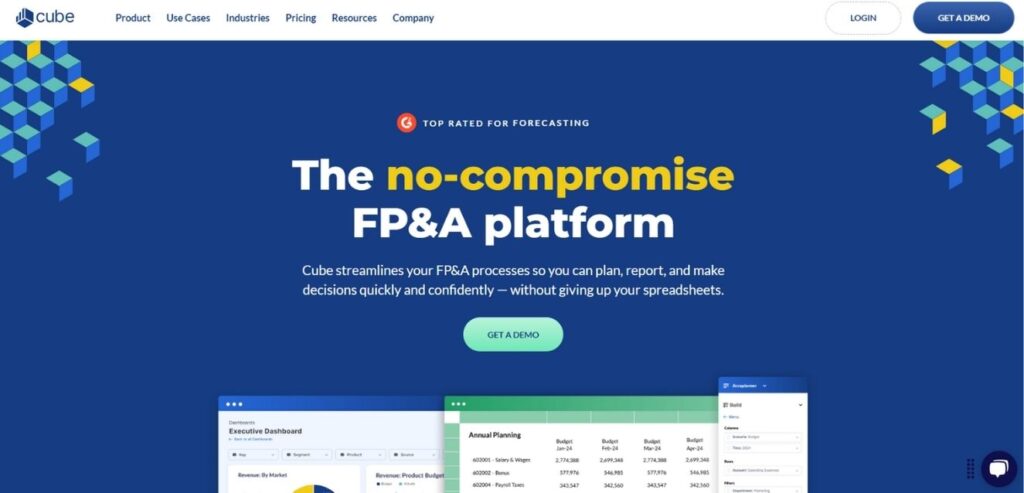

4. Cube Software

The AI-powered Cube Software functions as an FP&A (Financial Planning and Analysis) system which simplifies budgeting and forecasting together with reporting activities. Cube provides organizations with a solution that integrates ERP and CRM systems to create one central financial data repository while eliminating previous management inefficiencies.

AI-based insights in Cube help financial staff produce dependable forecasts as well as interpret performance patterns without difficulties. Business automation features of this tool enable organizations to minimize errors along with better results in financial reporting accuracy and higher-quality decisions. Organizations that want to optimize their financial operation processes must use Cube Software because of expanding AI adoption in the finance sector.

Key Features:

- Budget forecasting and financial planning operations benefit from AI-driven systems that automate several procedures.

- Seamless integration with ERP and CRM systems

- Predictive analytics for financial performance tracking

Best For:

- Corporate finance teams and CFOs

- Businesses needing AI-driven FP&A solution

- The solution serves organizations that want to automate their budget forecasting process

Price: The company determines prices according to customer size and requirements.

5. Zeni

The accounting operations and budget model management at Zeni rely on AI-powered software that professional staff members operate. The combination of artificial intelligence and human operators at Zeni enables businesses at any level to gain real-time AI tools for financial insights through automated work that keeps results accurate. The automated system provides financial management assistance, which helps businesses maintain accurate records at reduced budget levels.

Real-time financial tracking defines Zeni as an instrument that helps organizations both track their cash flow and see their cost and revenue patterns at the same time. Users receive better decision support through an AI system with predictive analysis and automated finance management, yet the tool delivers itself as vital for process optimization.

Key Features:

- An AI bookkeeping platform links automatic real-time tracking features to various functions as a whole system.

- The system performs tax calculations while grouping expenses internally regarding its built-in functionality.

- The system delivers predictive features for cash flow management to users together with tools for budget forecasting.

Best For:

- The instrument operates mainly with startup firms and small businesses that require automated accounting solutions.

- The financial organizations under CFO leadership require on-demand access to their financial data.

- The implementation of artificial intelligence technology must be included in all corporate tax compliance solutions.

Price: Plans start from ₹16,500/month ($200), based on company size.

6. Stampli

Stampli operates as an artificial intelligence platform for finance dedicated to making accounting process management easier. Machine learning algorithms used for invoice processing help the software gain essential data to perform automated approval workflows and detect irregularities. The financial operation effectiveness rises because automated processing reduces time requirements and eliminates human mistakes.

Stampli uses AI to integrate departments for running financial systems that decrease invoice processing duration while shortening payment delays. The tool serves as an essential system for finance operations to improve internal compliance and operational effectiveness by detecting irregularities and halting financial fraud activities.

Key Features:

- AI-assisted invoice processing and approvals

- Fraud detection and duplicate invoice prevention

- Seamless integration with accounting and ERP software

Best For:

- Accounts payable teams in mid-to-large businesses

- The deployment of automated invoice management requires business enterprises that want to implement this system.

- Organizations with financial operations requiring fraudulent marketplace protection make use of this solution.

Price: Each transaction number results in a separate payment through the established price model.

7. Quill AI

The application uses AI to process financial information points, which generate easy-to-read written financial reports. The financial data availability for employee stakeholders at Quill AI is improved because the AI system creates automated reports side-by-side with financial summaries. Visitors can use this tool with analysts, governmental agencies, and investment firms for better reporting functions.

Automated AI processes from Quill AI decrease financial reporting durations while simultaneously making automated reports more precise. Finance specialists gain clear decision-making abilities by using this tool because it converts chaotic data into structured reports that aid them in making knowledgeable choices for generating transparent financial documents.

Key Features:

- The automation process of financial reports runs on AI-based systems.

- Natural language processing (NLP) for financial documentation

- Real-time conversion of complex data into meaningful insights

Best For:

- Investment firms needing automated reporting

- Financial journalists and research analysts

- The solution provides benefits to organizations that want enhanced transparency in their financial reporting procedures.

Price: The business provides discounted prices for enterprises when clients make direct inquiries.

8. Trullion

Financial reporting and compliance are improved through Trullion as a computer-driven tool that automates lease accounting and financial reporting procedures. The platform collects financial data from contracts and documents using a system that ensures IFRS and GAAP compliance standards. Financial report transparency reaches higher levels when Trullion handles automated compliance work to reduce human error.

The adoption of Trullion by AI tools for finance organizations provides both enhanced operational efficiency in compliance management and superior financial statement information. Businesses can expedite their data retrieval process through their AI-based analysis features that ensure regulatory compliance and financial regulation updates.

Key Features:

- AI-powered lease accounting and compliance automation

- Financial records analyzed automatically lead to proper compliance with IFRS & GAAP standards.

- Auditors track and produce reports by using an AI-driven tracking system through this system.

Best For:

- Accounting firms and financial auditors

- Businesses needing compliance automation

- CFOs handling lease agreements and regulatory reporting

Price: Starts at ₹41,000/month ($500), varies based on usage.

9. Xero

Through cloud computing, Xero delivers its accounting solution with AI functionalities to automate bookkeeping operations and provide invoicing and reporting functionalities. The system utilizes instant transaction reporting features to access financial institutions and banks in order to generate reports that enable owners to maintain accurate financial records without complexity.

Through AI implementation, Xero provides its business users with enhanced processes that advance their financial operational capabilities. Businesses supported by Xero gain access to an easy-to-use main system that automatically tracks their spending and provides payroll capabilities and analytical tools.

Key Features:

- The system implements AITechnology to ensure autonomous operations of invoicing while it manages payroll duties and monitors budget-tracking activities.

- Cloud-based accounting with real-time bank integration

- The software tracks expenses automatically yet provides business users with cash flow assessment features within its system.

Best For:

- Small and medium-sized enterprises (SMEs)

- Freelancers and independent business owners

- The technologies of artificial intelligence accounting serve business organizations that run operations.

Price: Users obtain sophisticated functionalities while paying only ₹800 through the monthly subscription plan of Zoho Books.

10. SigFig

SigFig benefits its portfolio management audience because AI technology for finance delivers automated investment guidance features combined with management capabilities. Market trend evaluation runs parallel to risk analysis, which enables the tool to develop customized investment solutions specifically for users. The AI analytical systems of SigFig enable investors to obtain optimal portfolios that drive them to their financial goals.

The data analytics model used by SigFig enables users to get personalized advisory solutions with risk reduction and improved return potential. All investors from any experience level can select SigFig’s automated platform since it uses AI-powered algorithms.

Key Features:

- AI-powered portfolio management and risk assessment

- Market information evaluation allows investor recommendations to be developed.

- AI algorithms assist people in executing their financial planning procedures

Best For:

- Retail investors and wealth managers

- People who wish to employ AI technology as their financial advisory system

- Financial investment companies require automatic systems that enhance portfolio management practices.

Price: Fashioning basic portfolios for clients without fees, the company offers premium advisory services, which charge a 0.25% management fee based on client assets.

Explore AI tools:

How to Choose the Best AI Tools for Finance

Analysis of the following elements becomes vital before picking an AI tool for financial operations.

- Functionality & Use Case – Select a tool that suits your financial requirements, particularly for fraud detection risk management along with investment analysis purposes.

- Data Security & Compliance – The tool must adhere to financial regulations through secure data protection protocols.

- Scalability – The AI tool needs to adapt to ever-growing data quantities that accompany your expanding business operations.

- Integration Capabilities –The selected tool must automatically interface with every financial technology and program your business maintains.

- Accuracy & Performance – Find tools with accurate performance and secure functionality according to customer feedback and research scenarios.

- User-Friendliness – Easy-to-use features combined with an intuitive interface will help achieve the tool’s highest level of effectiveness.

- Customer Support – You should confirm that the tool provides dependable technical assistance and recurring software updates for uninterrupted operation.

Conclusion

Artificial Intelligence instruments conduct transformative work in the finance field through automated operations, superior decision support, and enhanced security functions. The AI tools for finance create opportunities from risk handling to investment approaches which help enterprises and users improve their financial operations efficiently. Financial business operations undergo a fundamental transformation through artificial intelligence because the technology influences transaction processes as well as fraud protection capabilities and analytical data generation.

AI expansion will require finance professionals to choose better AI tools. Financial professionals should assess functionality and security aspects together withthe integration capabilities of AI solutions in order to achieve maximum productivity and profitability. Businesses need to implement AI-driven financial solutions in order to maintain their market position against ever-growing market competition.

FAQs

1. What are AI tools in finance?

Financial institutions employ AI tools both for fighting financial fraud and risk management and for executing regulatory compliance that supports investment analysis capabilities as well as automatic customer service platforms and algorithmic trading platforms.

2. Can AI replace financial analysts?

Although AI enhances financial analytics efficiency, human decision-makers need to understand AI-produced information before making strategic choices.

3. Are AI tools secure for financial transactions?

Before implementing AI systems in transaction processing systems, financial institutions need to perform security evaluation tests on those systems.

Tools that work with finance applications implement enhanced encryption systems together with authentication protocols as per established requirements to safeguard against cyber threats.

4. How does AI improve fraud detection in finance?

The implementation of AI results in better identification of financial frauds. The real-time operations of AI Tools for Finance systems identify abnormal transaction behaviors that allow them to detect suspicious activities during their occurrence.

5. What is the future of AI in finance?

The financial industry demonstrates positive trends with its AI technology, which indicates its progress towards future stages of development. Technologies in finance leverage automated guidance systems to execute better analytics, which allows them to enhance operational speeds and system security through automated measures.