Managing risk is more important than ever. With new challenges like cyberattacks, changing regulations, and global disruptions, businesses are turning to smart tools to stay safe and stay ahead.

In 2025, the global risk management market is expected to reach $26.7 billion, showing just how fast companies are investing in risk solutions. Also, around 76% of businesses either already have or are planning to use an enterprise risk management (ERM) system.

In this article, we’ll explore the top 13 best risk management software available in 2025. Whether you’re running a small startup or a large enterprise, these tools can help you reduce risk, save time, and make better decisions.

Why Risk Management Software Is Important in 2025

- Proactively Identifies Risks: These tools help you spot risks—like cybersecurity threats, financial issues, or compliance gaps—before they turn into serious problems. Early detection can prevent loss and downtime.

- Ensures Compliance with Regulations: With constantly changing laws and standards (like GDPR, SOX, HIPAA), risk management software keeps you up-to-date and audit-ready, reducing the chance of legal penalties.

- Improves Decision-Making with Real-Time Data: Dashboards and analytics offer up-to-the-minute information, helping leaders make informed choices based on actual risk data, trends, and forecasts.

- Breaks Down Organizational Silos: By connecting departments—such as finance, IT, operations, and legal—these platforms ensure that everyone shares risk information and works toward a unified strategy.

- Saves Time and Reduces Human Error: Automated assessments, alerts, and reporting save hours of manual work and reduce the chance of mistakes, helping teams focus on what really matters—solving the problem.

How to Choose the Right Risk Management Tool for Your Business

- Evaluate Your Risk Landscape First: Understand what types of risks (cybersecurity, operational, legal, etc.) are most relevant to your organization so you can choose software that focuses on those areas.

- Check Integration Capabilities: Make sure the software works well with your current systems (like ERP, CRM, or IT tools) so data flows smoothly between platforms without needing duplication or manual entry.

- Look for Strong Automation Features: Choose software that can automate risk identification, scoring, reporting, and workflows. This boosts productivity and ensures consistency in how risks are managed.

- Review Security and Access Control: Your risk software should come with strong cybersecurity measures, role-based access, audit logs, and encryption to protect sensitive data from internal and external threats.

- Consider Scalability and Cost Structure: Pick a tool that fits your current budget but also has room to grow as your organization expands or takes on more complex risk and compliance requirements.

List of Top 13 Risk Management Software

1. LogicGate Risk Cloud

Risk Cloud by LogicGate is a sophisticated risk management program, which is highly adaptable to the needs of the modern business. It assists organizations to automate, scale as well as streamline, the operations involving risk, compliance, and governance using simple user interface. Risk Cloud is a flexible no-code risk software developed so that teams can build workflows that seamlessly fit industry frameworks of risks as well as business goals. You may not be able to eliminate an operation risk, compliance risk or third-party risk, or a risk associated with IT, but LogicGate gives you real-time visibility and control to effectively manage it.

The software is especially characterized by modularity which enables the user to buy only required features and modules, enabling cost-effectiveness and scalability. It also easily connects with most of the enterprise technologies such as Jira, ServiceNow, and Slack enabling cross-functional teams to interact easily. Its analytics and dashboard features are user friendly and provide real-time decision making and custom reporting. LogicGate also contains the audit trails as well as access control, which enables organizations to manage risk in life following the footsteps of their transparency.

Top Features:

- No-code workflow builder

- Customizable risk assessments

- Real-time dashboards and analytics

- Audit trail and version control

- Seamless integrations with enterprise apps

Website: https://www.logicgate.com/

Pricing:

- Available on request

2. Resolver Risk Management Software

Resolver is a renowned risk management platform, which facilitates firms to relate risks to incidents, audits, and keeping on track with administrative procedures within a single framework. It can help build a data-driven and proactive approach to risk management so that businesses could correlate their risk management strategy with the targets of the company as a whole. The cloud-based solution provided by Resolver uses all kinds of risks such as strategic, IT, operational risks, and even integrates capabilities similar to CSPM tools for managing cloud security posture. It also enables organizations to discover new risks as well as estimate the possible impacts even prior to the escalations of the risks into bigger problems.

The incident response and risk assessment in real-time is one of the best features of Resolver. It provides them with a centralized place to collect the data, where trends can be analyzed by teams to analyze root causes in order to prevent them in the future. They allow users to plot organizational risks against lines of business units, view interdependencies and keep a count of mitigating processes. The platform is compatible with a variety of existing regulatory guidelines, including ISO 31000, GDPR, SOX, etc. Also Resolver has a very high level of customer support and implementation services according to various industries.

Top Features:

- Centralized risk register

- Real-time incident and risk tracking

- Automated workflows and alerts

- Compliance management tools

- Advanced analytics and reporting

Website: https://www.resolver.com/

Pricing:

- Available on request

3. MetricStream Risk Management

MetricStream is a worldwide renowned corporation, an expert of governance, risk, and compliance (GRC) community. Its risk management software is designed in a way that enables giant corporations to easily and without fear maneuver their way through the complicated risk terrain. The platform offers a profound insight into already existing and upcoming risks, which enables executives to strategize accordingly based on the data provided. It is used to support enterprise risk, operations risk, third-party risk, IT and cybersecurity risk, and internal audit–all as part of a single, integrated tool.

This software has been powerful as it is highly scalable and deals with complex risks modeling. MetricStream has strong AI and machine learning features and it can be used to make predictions using predictive analytics and analyze situations by using scenario analysis that give business means of trying to think through how the various risk events may have played out. It does too involve automated management of issues, control monitoring and real-time dashboards. Its user-friendly interface and compatibility with ERP and financial systems are also valued by the users. MetricStream is a well-adopted product in the industries such as banking, insurance, healthcare and manufacturing since it has strong compliance features.

Top Features:

- AI-powered risk analytics

- Centralized GRC platform

- Support for multiple risk domains

- Real-time risk heat maps

- Integration with ERP and IT systems

Website: https://www.metricstream.com/

Pricing:

- Available on request

4. Fusion Framework System

The Fusion Framework System, developed by the Fusion Risk Management, is aimed at planning operational resilience using interconnection of risk management and business continuity and disaster recovery planning. It allows organizations to understand a 360 degree perspective on their risk status using risk intelligence coupled with business process data providing a better decision insight. This platform can be of great use to companies looking forward to getting an integrated solution to risk management that encompasses Incident management, IT service continuity, and third party risk.

The platform that fusion provides is very configurable and well equipped with features of automation that reduce manual effort as it makes the processes more efficient. Real-time dashboards and response workflows allow users to visualize those risks to monitor them across the entire organization and respond quickly to disruptions. Fusion additionally gives tools of the impact analysis, crisis management and resilience testing, therefore, it is an end to end solution. Having implemented the best practice standards and frameworks including ISO, NIST and FFIEC, it is domain-friendly to the highly regulated sectors.

Top Features:

- Operational resilience and business continuity tools

- Real-time risk intelligence dashboards

- Customizable incident response workflows

- Third-party risk monitoring

- Compliance with ISO and NIST

Website: https://www.fusionrm.com/platform/fusion-framework-system/

Pricing:

- Available on request

5. Riskonnect Integrated Risk Management

A market leader in cloud-based integrated risk management platforms, Riskonnect, has a cloud-based integrated risk management platform that can connect risk information across the enterprise that removes silos. It gives access to risk in real-time and enables companies to make more confident and smarter decisions. Riskonnect develops enterprise risk management (ERM), third party risk, IT risk, audit, insurance claims management software, and compliance all in a single building. It is especially optimal in the case of organizations which require cross-functional cooperation of risk, legal, compliance, and audit departments.

The automation engine that is provided with Riskonnect is one of the strongest aspects of the product, as the tracking and assessment of risks require less manual work. The platform allows prioritization of threats by the severity and impact as well as development of mitigating strategies that reduce the impact of risk within organizations. Combined with dynamic dashboards, customizable reports and automated warnings, Riskonnect guarantees that risk managers will be informed and capable of acting at all times. It is also capable of integrating with most business systems, which is beneficial to the flow and coordination of information in different departments.

Top Features:

- Cross-functional risk management

- Configurable dashboards and reports

- Automation and workflow management

- Real-time alerts and notifications

- Integration with ERP and IT platforms

Website: https://riskonnect.com/

Pricing:

- Available on request

6. LogicManager

Logic Manager is an efficient enterprise risk management solution, which enables organizations to determine risks, evaluate the risks and control the risks in all departments. It is especially common amongst medium sized and large organizations that consider setting up a centralized and scalable risk management system. LogicManager offers a risk-based solution to compliance, internal audit, cybersecurity, third-party management and strategic plans. As one of the leading risk management tools, it helps by breaking the walls of information silos by facilitating cross-functional cooperation and creating a transparent, accountable organization.

The number of pre-built frameworks and templates included in the software is large and they match to international standards (ISO, COSO, NIST, etc.), which simplifies the implementation process and accelerates it. The users will have an advantage of using an intuitive dashboard and reporting features that can be utilized in converting intricate risk data into practical insights. Its policy and procedure management tools ensure that your documentation is always up to date and accessible. Also, LogicManager offers professional guidance, which means that your business is not only digitized in terms of risk management practices but also optimized strategic-wise.

Top Features:

- Risk-based framework across departments

- Built-in templates for ISO, NIST, COSO compliance

- Dashboard and automated reporting

- Policy and procedure management

- Dedicated advisory support

Website: https://www.logicmanager.com/

Pricing:

- Available on request

7. CURA Enterprise Risk Management

CURA Software provides a comprehensive enterprise risk management platform tailored for organizations that require deep control and visibility into risk profiles. CURA enables users to build risk-aware cultures by aligning risk management with business goals and ensuring that everyone—from top management to operational staff—is aware of potential threats. Its intuitive design and modular structure let users tailor the system to different risk areas, including operational, strategic, compliance, and project risks.

One of CURA’s distinguishing factors is its ability to scale across global operations, making it suitable for multinational corporations and complex regulatory environments. With built-in risk libraries, automated workflows, and visual tools for risk assessment and control evaluation, CURA significantly simplifies the governance process. The system offers multilingual and multi-currency support and complies with global regulatory standards, making it particularly effective for financial institutions and multinational firms seeking centralized control with localized execution.

Top Features:

- Modular and scalable risk management

- Visual risk assessment and mapping tools

- Multilingual and multi-currency support

- Built-in risk libraries

- Compliance with global regulations

Website: https://curasoftware.com/

Pricing:

- Available on request

8. SAP GRC (Governance, Risk, and Compliance)

SAP GRC is a proven product, which helps businesses to manage risk, track compliance and governance throughout the operational environment. Being a member of the SAP ecosystem, it is well integrated with the rest of SAP modules, such as Finance, HR, and Supply Chain within the broader ERP software framework, which increases their risks of detection and mitigation through any level. SAP GRC offers facilities to review and control the access control, audit management, fraud management and regulatory compliance in real time.

The main reason why SAP GRC can be very effective and efficient is the incorporated automation and predictive analytics based on AI, allowing identifying potential risks even before they might cause serious problems. The software has elaborate and role-specific dashboards and key risk indicators (KRIs) that enables organizations to be able to address the requirement of complex regulatory requirements effectively. It is also more popular in industries that are heavily regulated such as banking, pharmaceutical and manufacturing industries where accountability and traceability are of great significance. In addition, SAP GRC is flexible in the sense that whatever changes in the regulatory environment does not necessarily force organizations to change their entire system.

Top Features:

- Integration with SAP ERP ecosystem

- Automated controls and fraud detection

- Role-based dashboards and access management

- Predictive analytics and risk modeling

- Regulatory compliance monitoring

Website: https://www.sap.com/india/products/financial-management/grc.html

Pricing:

- SAP Finance Base: ₹24,256.00/month

- SAP Finance Premium: ₹33,959.00/month

9. RiskWatch

RiskWatch provides a financial risk management software and risk assessment platform with high level of configuration and automation into industries e.g. healthcare, energy, finance, and government amongst others. Through its cloud-based solution it enables businesses to have risk assessments, audits and compliance checks without much manual operation. The software also distinguishes itself with a focus on risk scoring and prioritization and allows users to determine the most significant threats to operations, assets, and individuals.

The speed of implementation and ease of use are one of the main RiskWatch differentiators as the solution is simple to deploy and simple to operate, even the novice risk management teams can use it. Risk matrices, compliance frameworks and audit templates can be defined and configured by the users to cater to organisational requirements. The platform makes it possible to have constant observation and automatic update of the risk scores as more data is received. Moreover, RiskWatch provides extensive reporting functionality and dashboards that provide groundbreaking insights and may help one make data-driven decisions at any organizational level.

Top Features:

- Automated and configurable risk assessments

- Customizable risk matrices and scoring

- Real-time monitoring and alerts

- Compliance tracking and audit tools

- Industry-specific templates

Website: https://www.riskwatch.com/

Pricing:

- Available on request

10. IBM OpenPages

IBM OpenPages is an artificial intelligence-driven risk management solution built off of IBM advanced intelligence analytics and cognitive computing technology. It enables businesses to balance risk management and compliance on a vast scope of areas, such as operational risk, regulatory risk, IT risk and third-party risk. OpenPages is designed to scale and can easily be integrated with other services in the IBM Cloud and third party systems to provide end to end risk intelligence.

Among the strongest capabilities of IBM OpenPages is the fact that it utilizes Watson AI to streamline the collection of data, anomaly detection, and the generation of insights that otherwise could have been overlooked using the preceding technologies. The users will have the possibility to take advantage of AI-driven risk modeling, predictive analytics, and natural language processing to handle and analyze unstructured risk data. It also endorses control structures including Basel III, GDPR, and SOX. The fact that it has a modular scope allows it to apply to organizations regardless of size (eliminating both boutique and Fortune 500 corporations).

Top Features:

- AI-driven risk detection and analysis

- Seamless integration with IBM Cloud and third-party tools

- Predictive analytics and natural language processing

- Compliance tracking for multiple frameworks

- Scalable and modular architecture

Website: https://www.ibm.com/products/openpages

Pricing:

IBM OpenPages – SaaS:

- Essentials:

- ₹64,619.0625 INR/Instance

- ₹4,307.9375 INR/Capacity Unit

- Standard:

- ₹301,555.625 INR/Instance

- ₹4,307.9375 INR/Capacity Unit

- IBM OpenPages – On Cloud: Contact them

- IBM OpenPages as part of IBM Cloud Pak for Data: Contact them

- IBM OpenPages – On Premises: Contact them

11. nTask Risk Management

nTask is a multifunctional project management tool that, in addition, includes great risk management capabilities which can be used by small-to-mid-sized teams. Its risk management component enables its users to be able to trace, classify, prioritize and assign risk control measures in a very convenient manner. Possible risk can be assessed and represented with fixed like and impact ratings, which is represented in risk matrices. It simplifies the work of teams that can then focus on the most urgent threats and mitigate them ahead of time and within the framework of their projects.

The fact that nTask can tightly interlock a risk management system with a project planning system, meeting management and task tracking system is another one of the highlights of nTask. This integration makes sure risk is not trapped in a silo that is separate to the operations of the team on a day to day basis, but rather integrated within the process. Risk status categories can be customized, tracking of ownership and live updating of mitigation plans can also be performed. And with an intuitive and user-friendly interface, individuals or managers can assign risk status in a structured risk culture with nTask without having to spend on enterprise tooling.

Top Features:

- Integrated project and risk management

- Risk matrices with impact and likelihood scoring

- Risk tracking and ownership assignment

- Custom risk statuses and priority levels

- Affordable for small and medium teams

Website: https://www.ntaskmanager.com/product/risk-management-software/

Pricing:

- Premium: $4/month

- Business: $12/month

- Enterprise: Contact them

12. VComply

VComply is an up-and-coming GRC (governance, risk, and compliance) platform that aims to facilitate and automate compliance and risk throughout an organization. VComply has a lightweight interface, minimalistic design that makes it the best choice when it comes to SMBs or smaller/mid-market companies who will want a cost-effective scalable solution. It features risk registers, automation of risk workflow, assignment of tasks as well as tracking of compliances which makes it easy to deploy an effective risk structure. VComply is more suited in finance, medical and educational companies.

Among the key features of VComply, it has the ability to manage policies and compliance because with its use, businesses are able to produce, disseminate, and monitor policy declarations and compliance. The risk owners are able to delegate mitigation measures and monitor them in real-time. The clear structure and the modular design of the Tool allow the user to customize dashboards depending on the needs of risk and compliance objectives. It is also available at competitive prices, enabling it to be affordable to even the expanding businesses without losing functionality.

Top Features:

- Lightweight GRC platform

- Real-time compliance and policy management

- Customizable dashboards and reports

- Affordable and scalable for SMBs

- Risk register and task automation

Website: https://www.v-comply.com/

Pricing:

- Start-Ups & Non-Profits: Request for pricing

- PRO GRC Suite: $1,000/month

- Enterprise GRC Suite: Contact them

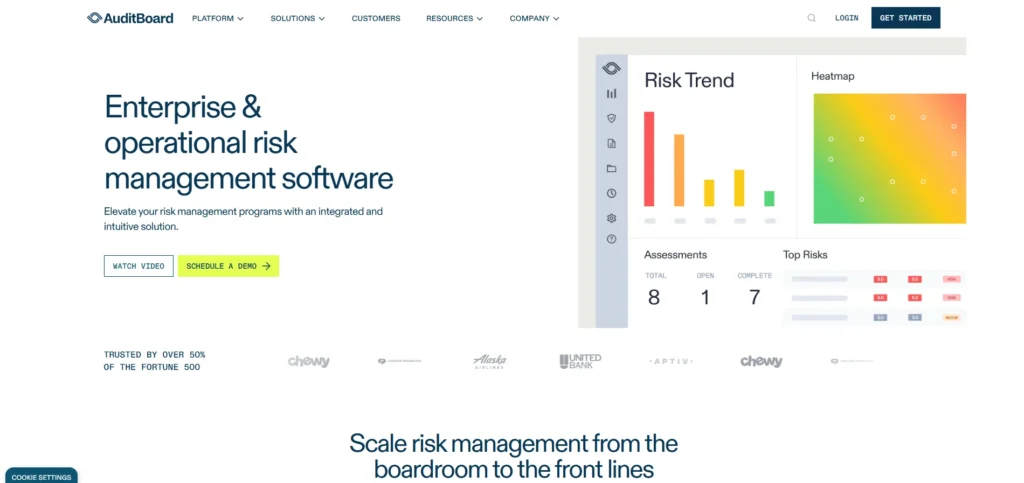

13. AuditBoard RiskOversight

AuditBoard’s RiskOversight is a premier risk management solution designed for enterprises looking to unify audit, compliance, and risk into one intelligent platform. As one of the most effective risk management tools, RiskOversight offers comprehensive visibility into enterprise risk profiles and allows for continuous risk monitoring and mitigation strategy tracking. With its intuitive design, the platform facilitates seamless collaboration between departments, promoting a strong risk-aware culture across the organization.

Built by audit professionals, AuditBoard RiskOversight allows users to define risk hierarchies, set risk appetites, and evaluate residual risks using powerful scoring systems. It also features built-in reporting tools, dynamic dashboards, and cross-functional visibility that enable C-suite and board-level decision-making. Integration with other AuditBoard modules such as SOXHUB and CrossComply creates a powerful ecosystem for companies aiming for total governance. It’s particularly effective for publicly traded companies and organizations subject to regulatory scrutiny.

Top Features:

- Enterprise-level risk oversight and dashboards

- Integrated with audit and compliance modules

- Residual risk scoring and reporting tools

- Dynamic risk hierarchy and ownership

- Board-ready visualizations and exports

Website: https://auditboard.com/product/risk-management

Pricing:

- Available on request

Conclusion

In conclusion, risk is a part of every business—but with the right tools, managing it doesn’t have to be stressful. Businesses face more obstacles than ever in 2025, including stringent laws and cyberthreats. The use of effective risk management software is therefore no longer optional; rather, it is a wise decision that protects your company, saves time, and improves decision-making.

The correct technology can help you keep ahead of the game, stay organized, and stay compliant whether you’re managing a small team or a major corporation. These 15 technologies, which range from automated risk assessments to real-time reports and safe data management, are among the best on the market right now. It is now up to you to research them and choose the one that works best for your business.

FAQs

1. Is Risk Management Software Expensive?

The features, user count, and size of your business can all affect the price. Some tools are affordable for small teams, while others are built for large enterprises. Many platforms offer flexible pricing or free trials to get started.

2. How Does Risk Management Software Help With Compliance?

It helps you stay up to date with laws and regulations by tracking compliance requirements, automating reminders, generating reports, and creating audit trails. This makes it easier to pass audits and avoid fines or legal trouble.

3. Can I Use Risk Management Tools Without Technical Knowledge?

Yes! Many modern tools are designed with user-friendly interfaces and easy setup options. To utilize them, you don’t have to be an expert in technology. Most also offer customer support, tutorials, and onboarding help to guide you through the process.