GRC tools just got real. Cyber-attacks rose 75 percent in the third quarter of 2024 compared to the previous year, according to Check Point Research, while IBM’s 2025 Cost of a Data Breach Report found that the global average cost of a data breach fell to $4.44 million. Meanwhile, the EU Digital Operational Resilience Act, new SEC disclosure rules, and early AI-governance mandates hit at once, exposing the limits of spreadsheets.

MarketsandMarkets now projects the eGRC software market to reach $34.5 billion by 2029. Boards want iron-clad proof that risk is controlled—and a return on every compliance dollar. In this guide, we’ll compare seven GRC platforms so you can cut risk, satisfy regulators, and protect the budget.

How We Evaluated the Platforms

We began with a single question: Will this software cut risk faster and at a lower total cost than doing nothing? Six factors gave us the answer:

- Breadth: Does the suite cover enterprise risk, regulatory mapping, third-party exposure, and new domains such as AI governance? Narrow point tools leave expensive blind spots.

- Automation: Continuous control monitoring and automatic evidence collection shrink audit work. Mid-sized firms that moved to high-automation GRC suites cut compliance labor by 20 percent to 30 percent.

- Integration depth: Strong APIs should merge data from cloud, DevOps, HR, and finance systems. Top vendors now ship with hundreds of pre-built connectors; for instance, OneTrust offers an integrations gallery with over 500 pre-built system connectors.

- Scalability: We checked how easily a product grows from a ten-person security team to a global enterprise. Overbuying slows adoption, while underbuying leads to costly rip-and-replace projects.

- User experience: Clean dashboards and low-code workflows drive adoption. A feature nobody uses delivers zero value.

- Cost and ROI: We weighed license structure, implementation effort, and the measurable savings or revenue gains each vendor can prove.

Keep these six filters nearby as you read; they separate glossy demos from lasting returns. Buyers now benchmark grc solutions on automation, integration depth, and AI support, which sharpens the signal between demos and durable ROI.

Comparison Snapshot

Quick view of how the seven tools stack up against our six criteria. Keep it handy when the CFO asks, “Why this vendor?”

| Platform | Coverage | Automation | Scalability | Cost / ROI signal |

| Vanta | Security-compliance focus | Very high | SMB to mid-market | Faster revenue, low staffing |

| MetricStream | Enterprise-wide, including ESG | High | Global enterprise | Long-horizon consolidation savings |

| Archer | Full suite, highly configurable | Medium | Large regulated orgs | Depends on committed admin team |

| ServiceNow GRC | IT-centric risk and compliance | High | Large IT-heavy orgs | Tool-sprawl reduction |

| AuditBoard | Audit, SOX, basic risk | Medium–high | Mid-to-large finance teams | External audit fee drop |

| OneTrust | Privacy, vendor, ESG | Medium | Mid to global | Fine avoidance, manual effort cut |

| LogicGate | Modular, build-your-own | Variable | SMB to mid-market | Pay-as-you-grow efficiency |

Remember, the best platform matches your pain points, not just the row with the most “high” marks.

Before diving into the seven tools, it helps to understand how GRC itself is shifting. Traditional audit cycles still treat compliance as an annual event, but automation has made it possible to keep evidence, access, and control checks live all year. The idea of continuous compliance—maintaining audit readiness every day instead of once a year—has moved from theory to practice in the last few years. Vanta, which first popularized the term across the security and compliance space, describes it as the difference between “proving security once” and “being secure always.” That mindset now shapes how modern GRC platforms are designed and why speed has become a primary ROI driver.

In-Depth Overview of GRC Tools

1. Vanta: continuous compliance at startup speed

Vanta was built for teams that push code on Friday night and still want to sleep. Plug it into AWS, GitHub, Okta, and more than 300 other cloud services; the platform then automates up to 90 percent of evidence collection needed for SOC 2, ISO 27001, HIPAA, and more. Laptop missing endpoint protection? Flagged. Off-boarded engineer with lingering access? Flagged. Gaps surface in minutes, not during next year’s audit scramble.

Speed converts to revenue. Tailor, a Tokyo SaaS startup, closed its SOC 2 in less than three months and unlocked U.S. enterprise deals after adopting Vanta, the company reports. BreachRx finished a SOC 2 Type I in just five days by using Vanta’s templates and continuous monitoring.

Setup is quick: connect your tools, answer a few scoping questions, and watch the dashboard populate. The trade-off is scope; Vanta centers on security compliance and offers no Monte Carlo risk models or sprawling policy libraries. If you need enterprise-wide risk analytics, consider a heavier suite.

For cloud-native companies that prize momentum, Vanta trims consultant hours, shrinks certification timelines, and gives prospects a trust story on day one.

2. MetricStream: integrated GRC for enterprise resilience

MetricStream’s ConnectedGRC platform brings enterprise risk, compliance, audit, cyber, and ESG into one low-code cloud stack. IDC’s 2025 MarketScape names it a Leader, noting that its AI capabilities “will accelerate productivity and outcomes, further enhancing ROI.”

In practice, risk owners see real-time heat maps that convert exposures into dollars, compliance teams get automatic alerts when rules change, and auditors pull evidence from a single, version-controlled vault instead of chasing spreadsheets.

Customers report hard savings: a 90 percent drop in audit review time, 58 percent faster issue resolution, and a 50 percent cut in audit follow-up costs after adopting MetricStream’s internal audit module.

Implementation takes effort; you’ll need dedicated administrators and a clear governance model, and pricing is quote-based, often six figures for large deployments. The payoff matches the lift: one platform replaces multiple point tools, surfaces cross-domain risks early, and sends teams into audits prepared instead of panicked. For complex, highly regulated enterprises, MetricStream can turn GRC from cost center to competitive advantage.

3. Archer: the configurable cornerstone

Archer has supported boardroom risk programs for nearly two decades. Its module-based suite covers risk, compliance, audit, and policy management, and you can reconfigure almost everything without code.

That flexibility shows up in the market. On Gartner Peer Insights, Archer earns an average rating of 4.2 out of 5 across more than 440 reviews, with users praising its customizable workflows. A bank can drag and drop a bespoke risk-scoring formula, and an insurer can map a local rule to existing controls before lunch. Because every team, from IT risk to internal audit, shares one data model, leaders gain a single source of truth.

The trade-off is complexity. Deployments often need consultants, and day-to-day administration is a dedicated role, not a side task. Smaller teams should set aside time and budget for training.

For large, regulated enterprises that value configurability over out-of-the-box speed, Archer still delivers long-term ROI. One platform replaces scattered spreadsheets, surfaces trends hidden in silos, and keeps reports board-ready on demand.

4. ServiceNow GRC: where IT ops meets compliance

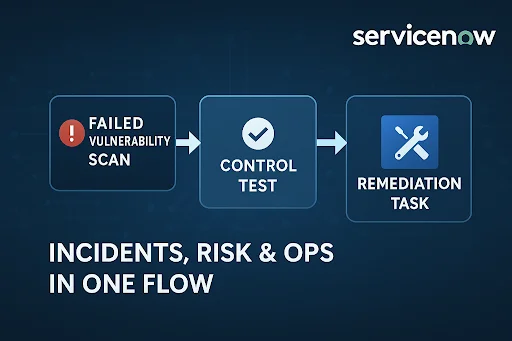

If your company already runs incidents and changes on ServiceNow, adding GRC feels like snapping in the last puzzle piece. Risk, compliance, and IT-service data share one platform, so a failed vulnerability scan can automatically trigger a control test, open a remediation task, and update real-time risk scores. No swivel-chair work required.

The shared CMDB powers the flow: asset records, configurations, and owners feed straight into risk assessments, cutting the “hunt-the-server” scramble. Inside the same no-code workflow builder, teams design quarterly access reviews or evidence-collection playbooks in minutes.

Results are measurable. ServiceNow reports a 66 percent reduction in quarterly control certification time and $2.6 million in annual savings after automating end-to-end GRC processes.

There is a hurdle: if you’re not already a ServiceNow shop, licenses and implementation can be significant, and non-technical users may need training to navigate IT-centric language. For organizations that live on ServiceNow, though, pulling risk and ops into one place reduces incidents, speeds audits, and gives leadership a story they understand.

5. AuditBoard: audit speed without the spreadsheet hangover

Born as a SOX lifesaver, AuditBoard still puts audit agility first. Its cloud interface feels consumer-grade: open a control, attach evidence, tag the owner, and move on. No version-conflict drama or last-minute PDF hunts.

Workflow transparency is the hook. Real-time dashboards flag every test, remediation, and sign-off, so you instantly know what is green, yellow, or red. External auditors value one-click access to documentation, which cuts their billable hours.

Adoption is quick. National Storage Affiliates trimmed SOX hours by 20 percent year over year after switching to AuditBoard, according to an AuditBoard case study, while ProSight Insurance saved 500–600 administrative hours and avoided 1–2 FTEs annually, another AuditBoard report says.

Depth is the trade-off. If you need advanced quantitative risk modeling or wide third-party analytics, you may layer another tool on top or choose a heavier suite.

For finance-led organizations chasing fast, measurable wins, AuditBoard delivers. Audit prep shrinks from weeks to hours, external fees fall, and your team pivots to insights instead of copy-pasting cells. Sometimes simplicity is strategic.

6. OneTrust: privacy muscle meets third-party insight

Few platforms wear more compliance hats than OneTrust. Launched during the GDPR surge, it now blends privacy operations, vendor risk, ethics hotlines, and ESG metrics in one portal.

Privacy is still the headline act: automated cookie banners, data-mapping tools, and subject-rights workflows keep you ahead of changing laws without hiring a legal army. The sleeper feature is vendor risk. OneTrust’s Third-Party Risk Exchange hosts more than 70,000 participating vendors, so instead of emailing spreadsheets you can pull a completed assessment in seconds and focus on the outliers.

Breadth brings complexity. Turn on every module at once and the learning curve feels steep. High-performing teams start with a core need—often privacy or vendor risk—then add functions as they mature. Each add-on affects budget, so map scope to concrete business impact.

The payoff can be large. A 2024 Forrester Total Economic Impact study found that OneTrust delivers 227 percent ROI and a seven-month payback, plus a 75 percent reduction in regulatory risk and 75 percent boost in privacy-team productivity over three years. Automating data-subject requests alone removes hours of manual work and cuts response times. When a single GDPR violation can cost four percent of global revenue, prevention pays for itself.

If your brand thrives on trust and customer data, OneTrust can turn privacy and third-party risk into a strategic asset, not just another checklist.

7. LogicGate: build-your-own risk cloud

LogicGate takes a different tack. Instead of a preset menu, it offers a no-code studio where risk managers drag forms, connect rules, and launch processes that match how the company works.

That fit pays off. Across more than 20,000 automated workflows, customers report over $250,000 in annual savings and more than 25 percent task-efficiency gains, according to LogicGate. Templates for PCI, HIPAA, and basic risk registers jump-start the first sprint; you can refine them as regulations or org charts change.

Freedom does require a champion. Someone needs both GRC savvy and curiosity to tinker, or the platform can feel like a blank canvas. Advanced analytics are lighter than in enterprise giants, but most mid-market firms never miss them.

Pricing scales by module, so you pay for what you use and expand when value is proven. For teams tired of forcing processes into rigid software or burning budget on custom code, LogicGate offers agility without developer headaches.

Choosing the Right Fit

Tools win or lose in context. A cloud-first SaaS startup races to unlock enterprise revenue, so speed and automation rules—Vanta or AuditBoard fit that brief. A multinational bank juggles hundreds of regulations across five continents; it gains more from MetricStream’s breadth or Archer’s configurability, even if rollout takes a year.

ServiceNow GRC shines where ITSM is already the heartbeat of operations. Teams that want a lighter entry point can compare risk-management softwares to see which vendors balance coverage with simplicity. OneTrust becomes indispensable when customer data and privacy fines keep executives awake. LogicGate appeals to organisations that value process agility over prescriptive feature lists.

Start with your pain point. Is it passing audits faster, taming vendor risk, or unifying siloed risk data? Match that priority to the platform designed to solve it natively. The tighter the alignment, the faster you see value—and the easier the budget conversation becomes.

Conclusion & Next Steps

We have covered a lot of ground, yet the takeaway is simple: pick the tool that solves your biggest headache first, then grow from there.

GRC software is not shelf décor; it pays dividends only when people use it. Budget time for training, connect the platform to your source systems, and keep controls synced with each reorg or new regulation. That rigor turns a license fee into lower breach odds and calmer audits.

Look ahead, too. AI governance, ESG metrics, and real-time risk analytics are racing up the agenda. Choose a vendor with a roadmap that matches your strategic horizon, not just this quarter’s checklist. As you modernize your risk and compliance stack, make sure the outcomes are measurable — your tools should clearly show how initiatives are moving the needle across security, efficiency, and ROI.

Ready to move? Short-list two platforms, run pilot projects, and measure concrete wins—hours saved, findings closed, deals closed faster. When you present those numbers, budget approval becomes a formality. We will see you on the other side of compliance chaos, with more sleep and fewer spreadsheets.

FAQs

How do I shortlist fast?

Match your top two pains to tools that solve them natively. Speed and audits: Vanta or AuditBoard. Enterprise breadth: MetricStream or Archer. ITSM driven: ServiceNow. Privacy and vendors: OneTrust. Custom workflows: LogicGate.

What is the quickest ROI Proof?

Run an eight-week pilot on one high-pain process. Track hours saved, cycle time, findings closed, and deals unblocked. Compare against license and setup cost.

How much Implementation lift is Typical?

Vanta, AuditBoard, LogicGate show value in weeks. MetricStream, Archer, ServiceNow, and broad OneTrust deployments often need a dedicated admin and phased rollout.

Will these Integrate with our Stack?

Yes, most ship large connector catalogs and open APIs. Validate your must-have systems during the pilot and document any gaps.

How do we Avoid Lock-in?

Secure data export rights, keep stable control IDs, use open formats, and set renewal flexibility in the contract.

Is our Data Safe on these Platforms?

Ask for independent attestations, encryption details, access controls, audit logs, and clear incident response commitments. Run a full vendor risk review.