In 2025, the country stands as the world’s 3rd-largest fintech ecosystem, powered by more than 10,000+ startups innovating in payments, lending, insurance, and digital banking. Fintech startups in India are driving financial inclusion, serving millions of underbanked users, and connecting payment gateways to investment platforms.

The Indian fintech market is valued at USD 44+ billion in 2025. It is projected to almost double to USD 95 billion by 2030, driven by UPI’s global leadership in real-time payments and an unstoppable shift toward digital transactions. From unicorn giants like Razorpay and PhonePe to new tech disruptors in credit, wealth, and insure-tech — this is the fastest-growing fintech hub on the planet.

In this blog, we explore the top Fintech Startups in India for 2026 that are shaping financial access, security, and innovation for a billion-plus people.

What is a Fintech Startup?

A fintech startup is one that makes use of technology to provide efficient financial services. These firms digitalize the traditional banking, payment, lending, insurance, and investment processes. Fintech startups develop affordable and easy-to-access financial solutions by integrating software, mobile apps, and data analytics. They disrupt the traditional systems, making finance accessible to consumers and to businesses in the emerging markets with globally spread markets.

How Big is the Fintech Startup Ecosystem in India

Indian fintech is one of the fastest-growing ecosystems in the world, and fintech startups in India are worth billions of dollars altogether. India’s fintech ecosystem in 2025 has become one of the world’s fastest-growing digital finance markets — valued at ~USD 44+ Billion and projected to reach USD 95.3 Billion by 2030 with a ~16.6% CAGR. With 9,000+ active fintech startups and an 87% adoption rate (far above the global average of 67%), India now stands among the Top 3 fintech ecosystems worldwide.

The industry is receiving large venture capitals that spur the use of digital payments and financial inclusion. The government programs, such as UPI and regulatory assistance, boost development. With billions of digital transactions processed each month, India is a global fintech innovation hub that is changing the accessibility of finance.

Top 20 Fintech Startups in India (2026 Edition)

1. Razorpay

Razorpay offers business-wide payment solutions to Indian business enterprises, which include a payment gateway, automated payroll, lending products, and neo-banking. The site handles billions of transactions every year and supports more than 10 million companies in India.

It simplifies otherwise complicated financial processes by consolidating them on a single dashboard, allowing merchants to receive money, manage subscriptions, and view working capital without issues.

- Problem Resolved: Distributed payment infrastructure that leads to inefficiencies in the operations of Indian businesses.

- Key Solution: Integrated business banking/boundary payment gateway.

- Business Model: The sources of revenue include transaction fees, subscription plans, and lending interest.

- Impact & Scale: Transacts billions of dollars every month with 10 million businesses across India.

- Why They Are Special: A Diversified package of payments, payroll, banking, and lending services.

- Website: https://razorpay.com

2. Groww

Groww helps to democratize the Indian stock market through a basic platform of stocks, mutual funds, ETFs, and IPOs. The startup has been scaled with an excess of 10 million users, and first-time investors can access wealth creation. It has an easy-to-use interface that removes the traditional barriers to investment, has educational content, no commission direct mutual funds, and an easy-to-open account.

Groww empowers millennials and Gen Z to, in one way or another, create financial portfolios without making much effort.

- Issue Resolved: Complicated investment procedures that do not allow millions to accumulate wealth in portfolios.

- Significant Solution: Easy interface with zero-commission direct mutual funds.

- Business Model: Attractive earnings of brokerage fees on a stock trade, and also interest on deposits.

- Impact & Scale: 10 million users investing in stocks, mutual funds, and digital gold.

- Reason why they stand out: It is user-friendly in nature and includes educational content aimed at first-time investors.

- Website: https://groww.in

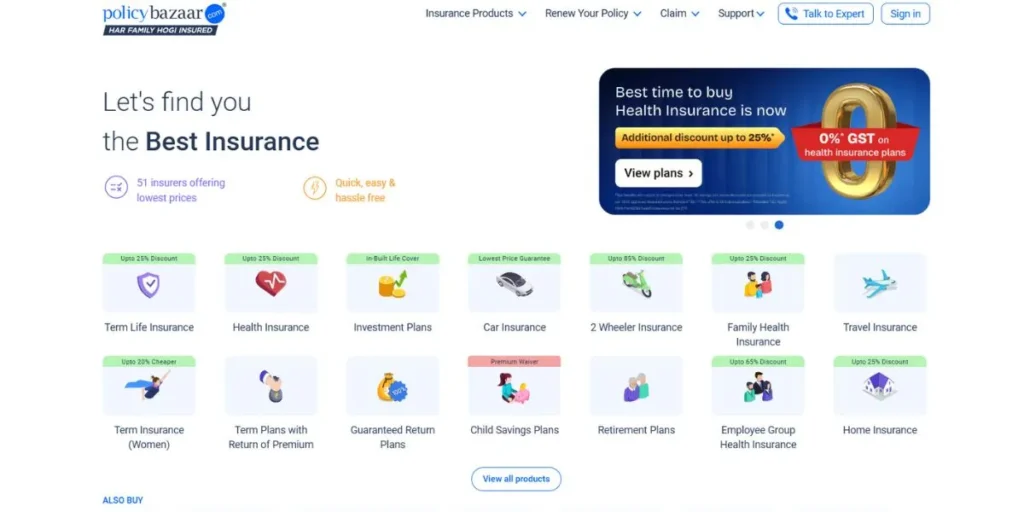

3. PolicyBazaar

PolicyBazaar is an Indian insurance comparison company that completely transformed the way insurance is compared in India. Users can compare insurance policies in health, life, car, and travel categories. The platform gathers the products of 50+ insurers and offers comparisons and expert advice.

PolicyBazaar has a base of millions of policies sold, and the convenient insurance purchasing process is made easy with technology-guided recommendations. It focuses on increasing the low insurance penetration in India by facilitating a more informed choice of the policy.

- Issue Resolved: Indian consumers were confused by the lack of transparency in the insurance markets.

- Key Solution: 50 insurers’ Aggregation platform with expert advice.

- Business Model: Commission on policies sold via the platform to the insurers.

- Impact & Scale: Sold millions of policies with 50 insurance companies.

- Why They Are Unique: A Comparison engine that does comprehensive comparisons with personalized recommendations of policies driven by AI.

- Website: https://www.policybazaar.com

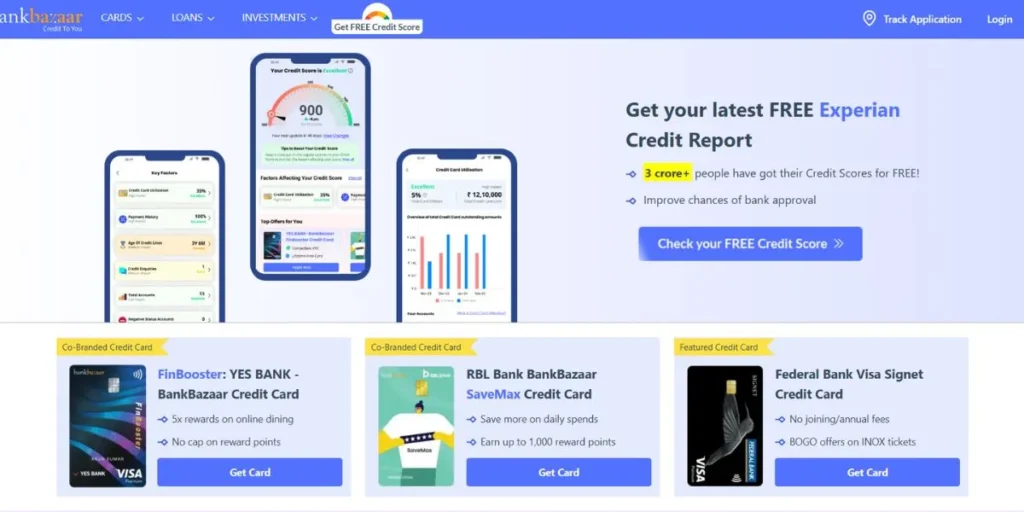

4. BankBazaar

BankBazaar is an online interface that is the leading marketplace in India for lending, credit cards, and insurance. The platform employs its own algorithms to connect users with customized financial products offered by 100+ partners.

The user receives real-time eligibility checks and competitive rate quotes without affecting their credit score. BankBazaar facilitates the process of applications and makes it easy to cut weeks of approval down to days without obscurity.

- Issue Resolved: Cloudy loan markets that cause trouble in securing competitive rates.

- Key Solution: Marketplace with customized rates of 100 banking partners.

- Business idea: Partner with banks and financial institutions and earn revenue on a commission basis.

- Impact & Scale: 100 financial institutions partnered to give out millions of loans.

- Their Uniqueness: AI-powered credit score insights with a personalized product match.

- Website: https://www.bankbazaar.com

5. JUSPAY

Juspay facilitates flawless payment experiences on the largest digital platforms in India, making billions of transactions. As one of the leading Fintech Startups in India, the company offers payment orchestration technology that ensures a high success rate of transactions through intelligent routing.

The SDK of Juspay is compatible with large e-commerce and food delivery as well as ride-hailing applications. Its user experience is improved through fraud detection and optimization of its checkout systems, which minimize payment failures.

- Issue Resolved: Failures in payment high rates are annoying the users and lowering merchant incomes.

- Sectional Solution: Payments orchestration to improve routing to increase success.

- Business Model: Merchant transactions based on using payment infrastructure services.

- Impact & Scale: Billions of dollars a year on behalf of the leading Indian online trading sites.

- Reason to be Memorable: Leading intelligence routing with 99 percent transaction success rates in the industry.

- Website: https://juspay.in

6. Paytm

Paytm was the first app in India to move to the digital realm of payment and has blossomed into a full-fledged financial services network. As one of the top fintech companies in India, the super-app will provide banking, insurance, lending, wealth management, and payment solutions. As a country with hundreds of millions of users, Paytm changed the way Indians conduct their transactions online.

It has merchant reach into millions of offline stores and serves underbanked communities through its payment bank, moving the country towards financial inclusion.

- Solution: The issue of cash dependency that hinders the adoption of digital business in urban and rural.

- Significant Solution: Super-app with payments, banking, wealth, and commerce services.

- Business Model: Interests charged on lending, interest charged on payment processing, and merchant service revenues.

- Impact & Scale: 350 million users, millions of merchants with whom Paytm takes payments.

- Reason They are Unique: Full-stack financial services and comprehensive ecosystem of payments to full-stack financial services.

- Website: https://paytm.com

7. PhonePe

PhonePe is leading the UPI payments market in India by allowing contactless transfer of money and other digital payments. The application helps in peer-to-peer transfer, payment of bills, recharge, and payment of merchants without any problem.

As one of the top Fintech Startups in India, PhonePe is the payment interface of choice in India, processing millions of transactions each month. It has diversified into insurance, mutual funds, and gold investments to form a complete financial platform used by the mass market.

- Solution to Problem: Multifaceted banking procedures that slow down the adoption of instant peer-to-peer money transfers.

- Key Solution: Basic UPI-based application that will allow immediate transfers and payments.

- Business Model: Merchant transaction fees and commissions in the sale of financial products.

- Impact & Scale: Billions of transactions every month, 450 million users registered in the country.

- Why They Are Unique: Market leader in UPI transactions with broadening financial services.

- Website: https://www.phonepe.com

8. CRED

CRED, as a credit card company, offers its creditworthy Indian members a reward for paying credit card bills on time. The application combines various credit cards, automating payments and providing unique rewards and experiences.

As one of the new fintech startups in India, the CRED community comprises high-trust users who have access to premium merchant offers, travel benefits, and financial products. It gamifies personal responsibility and creates the largest community of responsible people in India, with a package of rewarding lifestyle privileges.

- Solution Sought: Delays in credit card payments with credit scores and financial well-being.

- Solution: Automated bill payments that provide rewards for responsible credit behavior.

- Business Model: Generated merchant commissions, lending partnerships, and premium subscription fees.

- Impact & Scale: 10 million members with 800-plus credit scores visiting the platform.

- Why They Are Unique: Exclusive community model that gives creditworthy users luxurious experiences.

- Website: https://cred.club

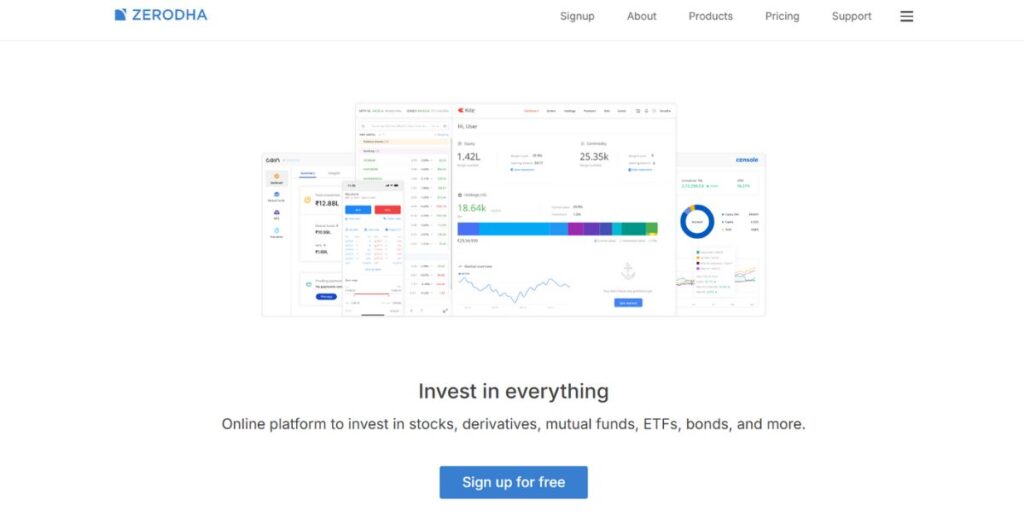

9. Zerodha

Zero-commission equity delivery trading and transparent pricing were innovations that disrupted Indian stockbroking by Zerodha. Millions of active traders are served by the discount brokerage using its advanced trading applications, Kite and Console.

As one of the top fintech companies in India, Zerodha’s educational programs, such as Varsity, democratize the knowledge of the market. It is the largest retail broker by volume in India, and it preaches the cause of investor education, and it still makes a profit without venture capital.

- Solution Found: Retail investors are locked out of stock markets due to high brokerage fees.

- The main Solution: Zero-commission delivery trades a flat fee on intraday trading.

- Business Model: Flat fee: intraday and derivative trades, no equity delivery.

- Impact & Scale: 6 million active clients, the retail broker with the highest trading volumes.

- Reason behind their uniqueness: Bootstrapped profitability and intensive emphasis on investor education programs.

- Website: https://zerodha.com

10. Lendingkart

Lendingkart is a technology-based lending firm that fulfills the working capital requirements of small and medium organizations. The site adopts alternative credit scoring to screen traditional underserved businesses for banks. Lendingkart offers collateral-free loans between lakhs and crores within a few hours with little documentation and release. Its data-driven model decreases the risks associated with lending and increases access to credit for the Indian MSME sector.

- Solution: Small business growth in Indian markets is hampered by low access to credit.

- Key Solution: Alternative credit scoring to allow fast, collateral-free business loans.

- Business Model: Income from the business loans paid to SME clients.

- Impact & Scale: Thousands of crores paid out to 1.5 lakh SMEs in India.

- Reason behind it: Proprietary credit model evaluating businesses based on non-traditional data.

- Website: https://www.lendingkart.com

11. Pine Labs

Pine Labs is a company that offers a wide range of merchant commerce solutions that include point of sale systems, payment reception, and consumer financing. The cloud-based platform of the company allows accepting various payment options by both offline and online merchants.

As one of the top fintech startups in India, the Buy Now Pay Later feature of Pine Labs at checkout promotes the value of the transaction. It has a presence in Asia serving lakhs of merchants with both payment infrastructure and data analytics to create business insights.

- Issue Resolved: Disjointed payment-taking systems that restricted the ability of merchants to transact and expand.

- Solution: Integrated commerce, payment, and financing solution.

- Business Model: Consumer financing interest, merchant subscriptions, and transaction fees.

- Impact & Scale: 150,000 traders in India and Southeast Asia clearing billions.

- What Makes Them Unique: Offline-to-online Business integration with embedded finances at the checkout points.

- Website: https://www.pinelabs.com

12. Upstox

Upstox is an equity investment and low-cost derivatives trading as a mobile-first platform that does not charge commissions. The brokerage uses technology to offer market analytics and order execution at lightning speed.

Upstox is making trading more democratic by educating and allowing millions of users with intuitive interfaces. Its clear pricing system erases any form of secret fee, which means that the stock market is now open to young Indians joining capital markets.

- Solution: Difficult trading websites are driving away the young Indians from the stock market.

- Main Solution: Mobile-first interface with zero equity delivery brokerage fees.

- Business Model: Flat rates on the intraday and derivatives, premium subscription services.

- Impact & Scale: 1 million active traders to invest in stocks through the platform.

- What Makes them Special: Mobile-native millennial investor platform based on technology today.

- Website: https://upstox.com

13. Slice

Slice reinvents credit cards among the young Indian digital-first customers with its mobile native platform. The fintech provides immediate issuing of cards, flexible repayment, and incentives that are based on millennial consumer spending habits.

As one of the new fintech startups in India, Slice relies on alternative data to determine creditworthiness, making credit more accessible than is the norm in traditional banking. Its interactive design and social capabilities provide a fantastic gaming experience to new credit users.

- Problem Resolved: Old-fashioned credit cards are unavailable to young Indians with less history.

- Key Solution: Instant digital credit cards using alternative underwriting models are put into place.

- Business Model: Interchange fees, interest on revolving credit, and partnered commissions.

- Impact Scale: 5 million users were issued cards, and credit became more accessible to youth.

- What makes the difference: Mobile-first experience that includes the ability to issue instant cards to millennials.

- Website: https://www.sliceit.com

14. Khatabook

The Khatabook project digitizes the ledger-keeping process for small Indian merchants and shopkeepers through a free mobile application. Businesses are able to log credit transactions, remind them of payment on the platform, and create reports.

Khatabook solves the informal credit system in India, where tens of millions of merchants transact using it. It intends to overlay financial services such as lending and insurance on its merchant network and make money through embedded finance.

- Problem Solved: Small business credit transactions were due to manual record-keeping, which led to errors.

- Key Solution: Free online ledger application to record/track credits.

- Business Model: The Merchant base is cross-sold in financial services, and lending partnerships are revenue.

- Impact & Scale: 20m merchants daily maintain business records on the app.

- Why They Are Noteworthy: Huge merchant network developing an infrastructure of an embedded financial services layer.

- Website: https://khatabook.com

15. Crediwatch Information Analytics Private Limited

Crediwatch offers salaried workers and gig employees instant access to personal loans on a mobile platform targeted at young people. The fintech offers AI-based credit evaluation to take out small-ticket loans in a few minutes.

As one of the top fintech startups in India, Crediwatch serves under-served credit segments with little documentation and easy repayment options. Its technology assesses other data sources, enabling the financial inclusion of millions of people in India who lack a traditional credit history.

- Lasting Remedy: Instant private loans with AI-based alternative credit ratings.

- Business Model: Interest payments on individual loans are deposited to platform users.

- Impact & Scale: 1 crore downloads, Thousands of crores given out as loans.

- Problem Solved: Emergency credit is not available to young professionals with no credit history.

- Why They Are Special: Quick disbursement of salaried young people through alternative data collected on a smartphone.

- Website: https://crediwatch.com

16. BharatPe

The BharatPe also provides free payment acceptance in QR code and instant settlement to small merchants. The service externalizes various UPI apps, and as such, merchants will not miss payments because of any restrictions of the apps. BharatPe entered merchant lending with working capital loans through transaction history. Its point-of-sale terminals and business management solutions generate an end-to-end merchant services platform that is fueling digitization.

- Issue Resolved: Merchants were losing sales because of the UPI payment acceptance restrictions that were on the apps.

- Business Model: Merchant lending interest, payment gateway charges, and advertisement revenues.

- Why They Are Different: Merchant-first using lending operations based on digital transaction history analysis.

- Website: https://bharatpe.com

17. MobiKwik

MobiKwik is a digital payments and fintech company that provides credit solutions, investments, and payment services. The application allows mobile recharging, bill payments, peer-to-peer transactions, and merchant transactions.

As one of the top fintech startups in India, the lending division of MobiKwik offers instant personal loans and Buy Now Pay Later loans. It provides a closed-loop digital payment system to India with millions of users and a highly accepted merchant payment network to cover the wide array of consumers.

- Issue Resolved: Disjointed online payment experiences that cause a hitch during consumer transactions.

- Key Solution: Unified wallet is used for paying, recharging, bills, and credit services.

- Business Model: Charging transactions, lending interest, and merchant service charges.

- Their Competitive Advantage: A digital wallet pioneer transforming into a full-scale fintech platform.

- Website: https://www.mobikwik.com

18. ClearTax

ClearTax makes filing and complying with taxes (in both individual and business situations) easier with the help of its automated service. The program takes one through income tax returns, GST filing, and accounting with little computer intervention.

The algorithms by ClearTax optimize the amount of refund and guarantee a high degree of accuracy. It manages complex tax regulations so that it can convert them to digital experiences that are easy to use, save time, and minimize errors, serving millions of taxpayers as well as thousands of businesses.

- Issue Resolved: Complicated tax laws that resulted in filing mistakes and administrative burdens in the country.

- Significant Solution: Automated tax filing software to make the returns easier to fill in for individual businesses.

- Impact & Scale: 10 million tax returns have been filed, which serve 1 million businesses per year.

- Why They are Special: An end-to-end tax compliance system with automated GST and income solutions.

- Website: https://cleartax.in

19. Niyo

Niyo collaborates with employers and banks to provide superior benefits, salary accounts, and no banking charges. The fintech offers wholesale forex rates on international travel cards without any markup fee. The mobile application provided by Niyo contains budgeting, instant loans, and investments.

It generates value to its salaried employees by redefining its salary accounts by offering them fee-free banking and lifestyle advantages, which used to be exclusive to premium customers.

- Problem Solved: Salaried employees are struggling with high banking charges and unfavourable forex rates.

- Prominent Solution: Free salary account using international travel cards at a wholesale rate.

- Business Model: Employer partnerships, exchange fee, and financial product cross-sell commissions.

- Why They are Different: Banking centered on employees with travel cards that are the best in the market, and no hidden charges.

- Website: https://www.goniyo.com

20. Indifi

Indifi offers small and medium-sized businesses customized working capital loans with data-based credit evaluation. The company collaborates with organizations to provide embedded financing to their dealer and distributor base. The technology of Indifi processes data on transactions, which allows lending out loans in a short amount of time without a lot of paperwork.

By digitalizing lending to the SMEs, it fills in the credit gap experienced by the Indian business ecosystem that drives growth and economic activity.

- Issue Resolved: The India SME sector is hindered by a shortage of working capital, which is restricting its growth potential.

- Fundamental Solution: In-house financing via alternative credit scoring by way of partnerships with enterprises.

- Business Model: The business loans are obtained by lending business interest through partner networks.

- Why They Are Special: Embedding credit in existing supply chain ecosystems, an Enterprise partnership model.

- Website: https://www.indifi.com

Fintech Startup Funding & Growth Opportunities in India

- Huge Market Potential: 190 million underbanked Indians in need of a digital financial services solution.

- Regulatory Support: Government programs such as UPI and the Account Aggregator framework, which enable innovation safely.

- Investor Interest: More than a billion dollars in venture capital is invested in fintech startups in India each year.

- Digital infrastructure: India Stack and Aadhaar allow transactions and identity verification to be easy.

- Export Opportunities: Fintech startups in India that can be copied in other emerging markets in the world today.

How to Start a Fintech Startup in India: Step-by-Step Guidance

- Problem Identification: Identify the underserved financial needs by interviewing customers and conducting market research.

- Regulatory Compliance: Obtain the required licenses from RBI, SEBI, or IRDAI as needed.

- Build Technology: Architecture to ensure a secure and scalable platform with strong data protection and compliance.

- Pilot Testing: Introduce MVP to a few users, use their feedback to improve it, then scale.

- Fundraising Strategy: Find angel investors and VCs with a defined business model and growth metrics.

Challenges & Risks for Fintech Startups in India

- Regulatory Complexity: Resources are consumed as regulatory bodies change their requirements and compliance rules.

- Cybersecurity Threats: Data breaches and fraud challenges necessitate ongoing investment in security infrastructure.

- Customer acquisition: With intense competition, user acquisition is costly, and retention challenges persist.

- Profitability Pressure: Startups continue to struggle to balance growth with sustainable unit economics.

- Legacy Integration: Integration into old banking systems brings about a barrier of technical and operational challenges.

Conclusion

The fintech ecosystem in India offers unprecedented opportunities in terms of innovation, financial inclusion, and entrepreneurial achievement. The sector is still drawing international investments and talent, with the help of the government, well-developed digital infrastructure, and enormous unexploited demand.

From payments to lending, insurance to wealth management, fintech startups in India are making finance democratic to hundreds of millions. To thrive in this field, would-be entrepreneurs are forced to juggle between innovation and compliance with regulation, customer confidence, and viable business models.

FAQs

What is it that makes the fintech ecosystem in India appealing to startups on a global basis today?

India has a large underbanked population, a favorable digital infrastructure (such as UPI), favorable regulation, and strong investor interest in India, providing the best environment to develop and scale fintech innovation.

What is the average amount of funding needed by fintech startups in India to start their operations?

A: Start-up capital is very diverse, as basic payment applications can require 50 lakhs to 2 crores, and more complicated lending applications can demand 5-10 crores in technology, compliance, and customer acquisition.

What are the major regulations that fintech startups in India have to follow?

There are RBI requirements for payments/lending, PMLA requirements for KYC, data protection regulations, and sector-specific regulations from SEBI (investments) or IRDAI (insurance).

What is the duration of the process of constructing and deploying a fintech product?

The average time to create an MVP is 4-6 months, regulatory approvals take 3-6 months, and market fit is achieved through an average of 12-18 months of iteration and customer validation.