The crypto market does not sleep, and the profit opportunities do not sleep either. Not only are AI bots more efficient, but they also enable traders to grow their operation without having to add to their manpower or resources, and as such, these bots are an absolute necessity in the modern, high-paced trading world. The use of modern ai tools for crypto arbitrage trading has transformed the way traders can exploit arbitrage opportunities between exchanges.

These advanced interfaces apply machine learning technology to algorithmically scan markets all the time, make blisteringly fast trades, and also automate risk management. No matter how long you have been trading or how new you are in arbitrage, the choice of the correct AI tool will determine whether you will be able to make money regularly or will lose out on many opportunities. This ultimate guide will discuss the best platforms that are transforming the scene of arbitrage trading in 2025.

What is Crypto Arbitrage Trading?

Crypto arbitrage is a trading technique that is used to exploit the difference in price of the same crypto-currency between two or more different exchanges that enables traders to buy below on one exchange and at the same time sell above on another to realize the difference (a risk-free profit). The approach takes advantage of the market inefficiencies that are inherent in different platforms because of differences in the liquidity levels, trading volumes, and geographical locations, where an AI crypto trading bot can act faster than manual traders.

As an example, Bitcoin may be listed at $45,000 on Exchange A, and at the same time at $45,200 on Exchange B, and therefore present a profit opportunity of 200 dollars per Bitcoin traded. Successful arbitrage is all about speed, accuracy, and the ability to keep an eye on multiple markets at once, and it is here that AI tools for crypto arbitrage trading truly shine, as they can automate much of these complicated tasks.

How AI Improves Arbitrage Strategies

- Hyperspeed Market Scanning: There is a possibility that one computer can scan hundreds of exchanges simultaneously seeking profitable opportunities within a millisecond that a human trader would never witness.

- Real-Time Price analysis: Smart algorithms track all the price changes, the volume of trades and market depth to predict the most profitable arbitration opportunities.

- Automated Risk Management: Smart AI will automatically compute the transaction fees, withdrawal limits, and slippage to ensure that trades are profitable after all costs are taken into consideration.

- Multi-Exchange Coordination: various exchange accounts can be managed in just a couple of clicks and even portfolios and buy/sell orders on multiple platforms can be coordinated simultaneously with the help of AI.

- Predictive Market Intelligence: Machine models to predict the most likely times of occurrence of arbitrage opportunities and their duration are based on past history of data.

- Adaptive Strategy Optimization: AI develops a more complex view of what constitutes a good opportunity based on experience in the market and correspondingly adjusts the trading thresholds.

Key Factors to Look for in an AI Arbitrage Tool

- Multi-Exchange Integration: Be sure that the platform has all the major exchanges that you desire to trade on with secure API connections and real-time feeds to cover smooth operations.

- Execution Speed: Find tools that allow millisecond-level execution of the trade, because an arbitrage opportunity can be claimed in seconds in the competitive markets of today.

- Fee Calculation Accuracy: The AI should calculate all the fees associated with trading and withdrawal as well as network fees to ensure that the trade, after all the expenses are removed, is profitable.

- Security Features: Select a platform with high security measures like API keys encryption, two-factor authentication, and withdrawal limits to protect your money.

- Risk Management Controls: Stop-loss limits, position sizing algorithms and exposure limits These are critical in capital preservation during turbulent times.

- Backtesting: You can test strategies and optimize parameters using historical testing capabilities to deploy real capital only in live trading conditions.

Comparison Table of AI Arbitrage Tools

| Name | Free Trial | Supported Exchanges | Max Execution Speed | Arbitrage Types | Pricing |

| 3Commas | Yes | 20+ | <1 second | Simple, Statistical | From $29/month |

| Cryptohopper | Yes | 75+ | <2 seconds | Simple, Triangular | From $19/month |

| ArbitrageScanner | Yes | 200+ | Real-time | All types | From $50/month |

| Coinrule | Yes | 10+ | <3 seconds | Simple | From $29.99/month |

| TradeSanta | Yes | 15+ | <2 seconds | Simple, Grid-based | From $14/month |

| Shrimpy | Yes | 20+ | <3 seconds | Portfolio-based | From $13/month |

| Binance Smart | N/A | Binance only | <500ms | Simple | Free |

| HaasBot | Yes | 25+ | <100ms | All types | From $28/month |

| Bitsgap | Yes | 25+ | <1 second | Simple, Futures | From $44/month |

| Wundertrading | Yes | 15+ | <2 seconds | Social Copy | From $9.99/month |

Top 10 AI Tools for Crypto Arbitrage Trading

1. 3Commas

Tagline: Smart Trading Terminal and DCA Bot for Crypto

3 Commas is an entire trading ecosystem bringing together advanced arbitrage opportunities and portfolio management. AI tools for crypto arbitrage trading are available on the platform, which allows using complex trading algorithms on multiple exchanges simultaneously. Its interface is very simple, and it offers a large spectrum of customizing that makes it appropriate to both beginners and professional traders who need automated services.

Key Features:

- Multi-exchange arbitrage bot Binance, KuCoin, Coinbase, Poloniex, Huobi, Bibox, HitBTC and others

- The portfolio rebalancing and DCA high-tech techniques

- TradingView technical analysis

- One- click trading on smart trading terminal

- Full risk and stop-loss provision

Why It Stands Out: A marketplace that has already been successful in Bot marketplace

Best For: Traders who are fully automated and professional in character

Note of Caution: The higher plans have higher initial cost which can impact on small trading accounts

Pricing: Free, plans start at $29/month

Website: https://3commas.io

2. Cryptohopper

Tagline: Automated Crypto Trading Bot Platform

Cryptohopper provides cloud-based trading automation using strong arbitrage detection algorithms. The site is also remarkable in offering both the newbie and expert traders the facilities to make the most of market inefficiencies. Its exchange provides users with the ability to replicate winning strategies of leading traders, and highly intelligent AI algorithms constantly monitor profitable opportunities on the supported exchanges.

Key Features:

- Cloud arbitrage scanning on 75+ exchanges

- Marketplace of trading strategies with successfully tested algorithms

- Integration of indicators and signals of technical analysis

- Strategies testing via paper trading

- iOS and android mobile application

Why It Stands Out: Biggest marketplace of strategies with community approach

Best For: Novices who would like to replicate successful arbitrage tactics

Note of Caution: There is variability in strategy performance and history is no indicator of success going forward

Pricing: Prices begin at $19/month, free trial

Website: https://cryptohopper.com

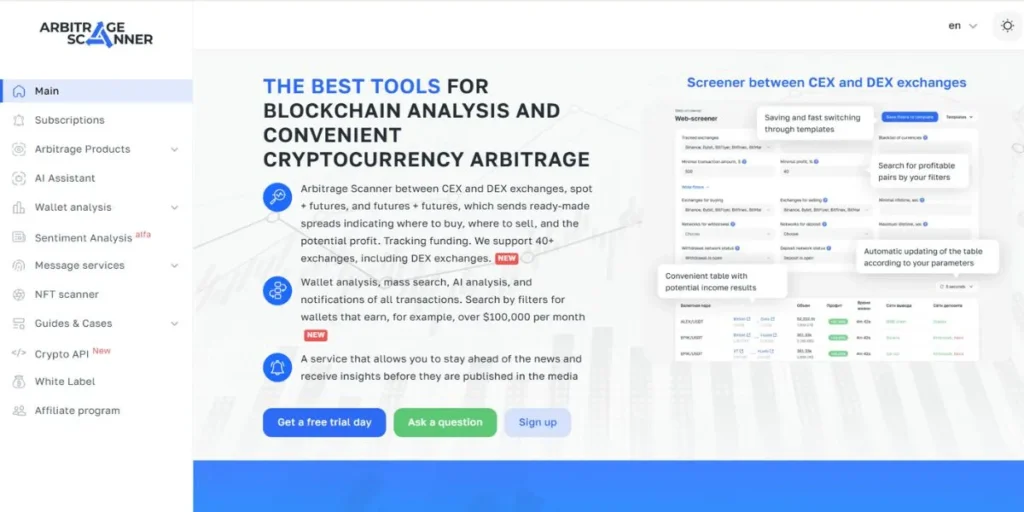

3. ArbitrageScanner

Tagline: Real-time Cryptocurrency Arbitrage Opportunities

ArbitrageScanner is a complete cryptocurrency arbitrage trading platform that supports both centralized exchanges and decentralized exchanges. AI tools for crypto arbitrage trading are integrated into this dedicated platform, which is specifically designed to detect arbitrage opportunities and provides real-time scanning with the ability to detect profitable opportunities based on hundreds of trading pairs. The tool gives comprehensive profit estimations with all the additional costs and timings of execution.

Key Features:

- Live monitoring of 200+ exchanges such as DEXs

- Fee-oriented profit calculations in details

- Analytics and data on historical arbitrage

- Automated trading interface (API) access

- Opportunity custom alert system

Why It Stands Out: The best comprehensive coverage of the exchange including DeFi protocols

Best For: Professional arbitrage traders who need to analyse the market in depth

Note of Caution: Technical knowledge is needed to automate trading

Pricing: There is a free version, premium plans start at $50/month

Website: https://arbitragescanner.io

4. Coinrule

Tagline: Automated Trading Rules for Everyone

Coinrule is a novice arbitrage trader platform that makes complicated trading algorithms easy to understand using an intuitive rule-based interface. The platform is designed to enable non-technical users to create unique arbitrage bots with simple rules based on the logic of if-this-then-that, which makes advanced trading available to non-technical users. Its AI tools for crypto arbitrage trading engine will constantly keep track of market conditions and automatically execute based on pre-determined conditions.

Key Features:

- Drag and drop bot design tool

- Off-the-shelf arbitrage strategy templates

- More than 10 major supported exchanges

- Portfolio tracking and analytics in real time

- Read-only API keys Security-first approach

Why It Stands Out: The most friendly user interface of non-technical traders

Best For: Amateurs who want easy automation in arbitrage

Note of Caution: The lesser number of higher-level features like in professional platforms

Pricing: Free plan, paid plans starting at 29.99/mo

Website: https://coinrule.com

5. TradeSanta

Tagline: Crypto Trading Bot for Everyone

TradeSanta – Crypto arbitrage finder mobile-first arbitrage trading to the masses TradeSanta is a mobile-first crypto arbitrage finder with native iOS and Android apps. The platform allows trading using the classic grid strategy and detects opportunities that can be used in arbitrage, providing the user with several ways to earn money with market fluctuations. Its artificial intelligence algorithms determine trading parameters that constantly change on the basis of volatility and frequency of opportunities in the market.

Key Features:

- iOS and Android native mobile apps

- Arbitrage detection supplemented with grid trading

- A combination of exchanges such as Binance and KuCoin supported by 15+

- Strategy sharing and social trading

- Portfolio and automatic rebalancing

Why It Stands Out: Great mobile trading experience via native apps

Best For: Traders who are mobile and wish to have access to arbitrage on the move

Note of Caution: Lack of support of advanced analytics relative to desktop environments

Pricing: There is a free trial and plans start at 14/month

Website: https://tradesanta.com

6. Shrimpy

Tagline: Professional Portfolio Management for Crypto

Shrimpy puts an emphasis on portfolio optimization and rebalancing and feeds the arbitrage opportunities into the trading algorithms. The platform relies on sophisticated AI tools for crypto arbitrage trading to ensure the best possible asset allocation while taking advantage of price disparities across exchanges. It has an institutional-level infrastructure that provides it with the ability to execute reliably in high-volatility conditions.

Key Features:

- Automated portfolio rebalancing fully integrated with arbitrage opportunities

- More than 20 exchange integrations linked through a unified interface.

- Advanced analytics in tandem with performance monitoring.

- Usage of the platform’s API to create custom trading strategies.

- Dollar-cost averaging with arbitrage optimization

Why It Stands Out: its portfolio management suite, augmented by arbitrage.

Best For: long-term investors looking to derive arbitrage income.

Note of Caution: Centers more on portfolio management than on pure arbitrage.

Pricing: Basic plan is free, professional plans start from $13/month

Website: https://shrimpy.io

7. Binance Smart Arbitrage

Tagline: Built-in Arbitrage Bot for Binance Users

Binance users may tap into the crypto exchange’s automated arbitrage trading software, which can serve as an effective complement to their current trading strategy. By doing away with the dependence on external services, the native tool brings robust arbitrage capability directly into the Binance ecosystem. The tool capitalizes on Binance’s deep liquidity and low fees to squeeze out optimal arbitrage profits.

Key Features:

- Integrated natively into the Binance ecosystem

- Direct access to Binance’s deep liquidity pools

- Trading fees are lowered for BNB holders.

- Instantly set up and activate with a single click.

- Integrated risk-management controls

Why It Stands Out: a seamless integration with the world’s largest crypto exchange.

Best For: Binance traders in search of an uncomplicated way to automate their arbitrage operations.

Note of Caution: Functional only within the Binance ecosystem.

Pricing: Free for Binance users, regular trading fees applies

Website: https://binance.com

8. HaasBot

Tagline: Advanced Cryptocurrency Trading Automation

HaasBot is the highest level of arbitrage trading platforms with its institutional-level functionality and customization capabilities. The site caters to more complex arbitrage strategies such as triangular arbitrage and inter-exchange arbitrage. Its advanced AI tools for crypto arbitrage trading engine is capable of making multi-leg trades, including managing risk across several positions at once.

Key Features:

- High-level arbitrage techniques such as triangular arbitrage

- High-frequency trading 25+ exchange integrations

- Indicators development and backtesting

- Extreme order types and position control

- Security and reliability to institutional levels

Why It Stands Out: The most advanced features of a professional arbitrage trader

Best For: Advanced traders with sizeable capital

Note of Caution: Learning curve is steep and more expensive

Pricing: Plans start at $28/month and up to $348/month

Website: https://haasonline.com

9. Bitsgap

Tagline: Crypto Trading Bot and Portfolio Management

Bitsgap integrates the arbitrage-detecting system and a full-featured portfolio management system. The tool can provide manual arbitrage scanning and automated bot trading, meaning that users can select the extent of their engagement. Its AI market analysis helps to understand the most favorable arbitrage opportunities and simultaneously maintain risk across positions.

Key Features:

- Integrated arbitrage and money management station

- More than 25+ exchange integrations with futures markets

- Best-execution smart order routing

- High-level charting and technical analysis programs

- Robotic rebalancing of portfolios

Why It Stands Out: Full-service trading suite with particular emphasis on arbitrage

Best For: Traders who want to trade end to end

Note of Caution: Beginners can be overwhelmed by the feature complexity

Pricing: Plans starting at $44/month and 14-days free trial

Website: https://bitsgap.com

10. Wundertrading

Tagline: Social Copy Trading and Automation Platform

Wundertrading introduces a social trading aspect into arbitrage automation so that users could follow successful arbitrage strategies of the best performers. The platform’s AI tools for crypto arbitrage trading evaluate the performance of traders and the market environment to advise the most appropriate strategies to each user according to their risk profile. Its grassroots style assists in making money-making arbitrage methods more democratic.

Key Features:

- Arbitrage social copy trading

- Strategy suggestions enabled by AI

- 15+ supported exchanges with harmonized interface

- Risk analysis and performance analytics

- Social marketplace of strategy sharing

Why It Stands Out: Social trading method to automate arbitrage

Best For: Traders who would like to copy effective arbitrage strategies

Note of Caution: Success of followed traders is the determinant of performance

Pricing: Free or paid plans (starting at $9.99/ month)

Website: https://wundertrading.com

Risks and Red Flags to Watch Out For

- Market Volatility Risks: Market volatility may remove arbitrage opportunities during the process, leading to losses in cases when trading does not occur at the same time across the exchanges.

- Problems with Exchange Connectivity: Not every exchange has a stable API and will lead to a failed trade leaving a partially complete arbitrage position that can generate a loss.

- Sneaky Fee Structure: Other platforms do not explicitly state all the trading fees, withdrawal charges and network charges and this can make seemingly successful trades result in a loss.

- Liquidity Constraint: Low liquidity on the target exchanges may not allow big arbitrage orders to be completed at the anticipated prices, minimizing or completely removing earnings.

- Regulatory Compliance Issues: The arbitration between courts can be an issue of concern since evolving regulations in different jurisdictions can affect business activities in trading.

- Risks of Over-Saturation: As additional bot comes into play, the possibilities of mediation can soon narrow, and profitable arbitrage will be more and more competitive.

Best Practices for Safe AI Arbitrage Trading

- Begin with Paper Trading: Paper trading or demo accounts should be used to test your crypto arbitrage trading strategies with your Ai tools so that you know how they perform before risking real money.

- Spread Your Portfolio: Do not depend on one tool, use several ai tools for crypto arbitrage trading to diversify and seize more opportunities in various market segments.

- Enforce Tight Risk Limitations: Establish maximum position size, a loss limit each day, and stop-loss to ensure that your capital is not subjected to market volatility or system crash.

- Keep an eye on exchange health: Check the status of exchanges, API stability, and withdrawal times regularly to ensure you do not get caught in a position when the exchange is under maintenance or unavailable.

- Maintain Sufficient Reserves of Capital: In order to exploit tiny deviations, you usually require a large amount of capital and liquidity; thus, to get the best chance, you should maintain sufficient cash on various exchanges.

- Keep up to Date with Regulations: Keep abreast with regulations in your jurisdiction and stock exchanges you trade in to be legally compliant and prevent any legal problems to automated trading.

Conclusion & Recommendations

The industry of AI tools for crypto arbitrage trading has changed incredibly, providing advanced solutions to all traders. The achievement of arbitrage trading is not only to select the appropriate tools, but also to be aware of market factors, to manage risks, and to have reasonable expectations. Newcomers can use the services of Coinrule and TradeSanta, which are easy to learn, and more experienced users may want to take advantage of the complexity of the HaasBot or ArbitrageScanner.

Keep in mind that crypto arbitrage trading AI tools are enablers, not profit insurance; market conditions, competition and quality of execution are very important factors in your success. For those exploring trading business ideas, begin with a small operation, fully test it, and slowly expand your operations as you become experienced and confident with the performance of your chosen platform.

FAQs

How much capital do you need to trade AI arbitrage?

The majority of the platforms need at least 1,000-5,000 dollars to make any profits, still considerable after subtracting the fees, yet some tools operate with smaller sums to learn.

What is the profit I will get out of AI arbitrage trading?

The realistic expectations are between 0.5-3 % monthly returns on the basis of market conditions, capital size and tool efficiency.

Can people who do not know how to arbitrage use AI arbitrage tools?

Yes, such sites as Coinrule and Binance Smart Arbitrage have rather simple interfaces, but it is better to be familiar with the fundamentals of trading.

Is it necessary to know the technical details in order to use these tools?

Although rudimentary knowledge is useful, most of the current AI tools for crypto arbitrage trading provide an intuitive interface that does not require much technical knowledge.

What is the greatest threat in automated arbitrage trading?

Network connection problems and market instability are the main ones, which can result in unfinished transactions or unforeseen losses.