Regardless of your work arrangement—whether as an employee, freelancer, or small business owner—having a proper pay stub is essential. Pay stubs act as proof of income and are often required for bank loans, rental agreements, visa applications, or tax filings. However, creating them manually can be time-consuming and prone to errors.

The global payroll and HR software market reflects this demand—it’s projected to grow from $35.27 billion in 2024 to $38.82 billion in 2025, with a strong annual growth rate of 10.1%. At the same time, freelancing and independent work are rising worldwide. In fact, by 2028, freelancers are expected to make up nearly half of the global workforce. These shifts highlight just how valuable fast and accessible payroll tools have become.

In this article, we’ll explore the Top 15 Best Paystub Generators available today. Each tool has its own strengths, whether it’s affordability, customization, or compliance with local tax rules. By the end, you’ll know exactly which generator best fits your needs—so you can save time, stay compliant, and focus more on your work.

Why Use a Paystub Generator?

- Saves Valuable Time and Effort – Instead of manually calculating salaries, deductions, and taxes, a paystub generator automates the process and creates accurate stubs within minutes.

- Creates Professional Income Proof – The generated stubs look official and polished, making them widely accepted by banks, landlords, and financial institutions for verification purposes.

- Reduces Human Errors – Since the software calculates everything automatically, there’s no risk of miscalculations that often happen when using spreadsheets or doing math manually.

- Affordable Payroll Solution – Most tools cost only a few dollars per stub, which is far cheaper than hiring a full-time accountant or investing in expensive payroll software.

- Works for Anyone, Anywhere – Whether you’re a freelancer, contractor, small business owner, or employee, these tools provide globally valid income documentation in a hassle-free way.

Key Things to Look for in a Paystub Generator

- Accuracy in Tax and Deduction Compliance – The generator should follow local tax laws, including federal, state, or regional rules, ensuring your stubs are legally valid.

- User-Friendly Interface – Even someone with no accounting background should be able to generate stubs easily without complicated steps.

- Customization and Branding Options – A good tool lets you add company logos, choose templates, and adjust details so the stub matches your business identity.

- Instant Access with Secure Processing – Look for platforms that provide immediate downloads in PDF format while using encryption to keep sensitive salary data safe.

- Reliable Customer Support – Responsive assistance through chat, email, or phone is essential if you encounter issues during stub generation or need help correcting details.

List of Top 15 Best Pay Stub Generators

1. PayStubCreator

PayStubCreator is considered to be among the most popular online paystub generators that are trusted by small companies, freelancers, and independent contractors. It is created in such a way as to enable individuals and organizations to create correct and professionally looking pay stubs in minutes. No matter whether you are an employer who has to organize various employees, or a freelancer, who must provide some income evidence to a loan issuer and a rental company, this tool will help you to prepare legally verified and IRS-accepted stubs. It is time-saving and yet accurate, with an easy-to-use interface that processes on the fly.

The site provides several calculations of state taxes, and it is thus very handy when it comes to U.S.-based employees. All users need to do is input details such as the company information, the employee details, salary, and deductions, and then the system automatically creates a professional stub in PDF format. Security is also one of the priorities, because PayStubCreator guarantees that both personal and financial information is completely encrypted.

Top Features:

- State & federal tax compliance

- Instant PDF download

- Accurate calculations for deductions

- Professional and customizable templates

- Secure, encrypted platform

Website: https://www.paystubcreator.net/

Pricing:

- Available on request

2. Real Check Stubs

Another most plausible site to use in order to come up with professional pay stubs is RealCheck Stubs. It is particularly well-liked by freelancers and small business owners who require a quick, safe, and convenient system. Real Check Stubs has a simplified interface enabling you to make various stubs within a few minutes, and it is a time- and energy-saving tool. The site is also mobile, which means that you can create stubs anywhere without a desktop.

The difference is that Real Check Stubs focuses on flexibility. It offers templates that can be customized and allows you to pay every week, every two weeks, every three weeks, or every month. Also, the tool provides a preview option that is free of charge, so you can verify everything prior to payment. This guarantees that you only pay the correct stubs of professional quality.

Top Features:

- Multiple pay frequency options

- Free preview before purchase

- Mobile-friendly interface

- IRS-accepted format

- Customizable templates

Website: https://www.realcheckstubs.com/

Pricing:

- $8.99

3. PayStubs.net

PayStubs.net is a highly effective solution for the production of pay stubs online. The tool is created in a simple way, which is why it can be recommended to individuals and small businesses that need to develop proper documentation of income. It has a sophisticated system that automatically computes deductions, taxes, and net pay and minimizes the possibility of human error. Professional-grade templates provide users with more than just accurate stubs; they are also easy to read and visually appealing.

Customer service is also reputable on the platform, where you will be advised in case you have problems when creating stubs. PayStubs.net highly values adherence to federal and state tax regulations, which makes it a reliable choice for both workers and employers. Along with its smart financial tools, it accepts a variety of formats and is acceptable to just about all landlords, financial institutions, and government agencies.

Top Features:

- Automatic tax and deduction calculations

- Professional templates

- Customer support system

- Accepted by financial institutions

- Fast and reliable processing

Website: http://paystubs.net

Pricing:

- Free

4. Check Stub Maker

Check Stub Maker is an easy-to-use software suitable for both individuals and businesses in need of quick, precise, and IRS-compliant pay stubs. It allows one to open several stubs simultaneously, a feature that is particularly useful to the owners of smaller businesses who have to run payroll. The interface is straightforward and streamlined, making it easy to understand even for first-time users. The users have fast processing with secure encryption, so they are assured of the correctness and the safety of their information.

The Check Stub Maker has one of the biggest strengths in that it is capable of producing stubs that comply with the IRS requirements. The site has different customization features, and it is simple to tailor the site to meet particular business requirements. It also provides customer services in case the customers require assistance when making their documents. It is a time-saving and economical choice to create professional pay stubs overall.

Top Features:

- IRS-compliant pay stubs

- Multiple stub generation

- Customizable options

- Secure data protection

- Fast and easy process

Website: https://checkstubmaker.com/

Pricing:

- Free

5. StubCreator

StubCreator is a contemporary web-based paystub generator that enables business organizations, contractors, and employees to generate professional pay stubs at their convenience. The platform is simply oriented, and thus can be used by users without accounting or payroll expertise. Users can create the correct pay stubs in several minutes by entering simple details like the company name, employee details, salary, and tax information.

The interface is simple, and the tool provides the flexibility of different pay periods with an option of weekly, bi-weekly, semi-monthly, and monthly payments, along with support for popular payment gateways to make payroll management even smoother.

The notable feature of StubCreator is that it is customizable and inexpensive. The user can customize pay stubs with company logos and choose an artwork design from various templates, which makes the paper seem official and branded. It is also affordable, and is a more affordable substitute to employing accountants or buying elaborate payroll programs. Another positive attribute is the issue of security; StubCreator is an encrypted technology that stores sensitive financial information. StubCreator has the instant download function and professional layouts, offering an excellent way to choose between individuals and small companies.

Top Features:

- Easy-to-use platform with simple data entry.

- Supports multiple pay periods and formats.

- Customizable pay stubs with logos and templates.

- Affordable pricing compared to payroll services.

- Secure and encrypted data protection.

Website: https://stubcreator.com/

Pricing:

- $4.99/mo

6. 123PayStubs

123PayStubs is a self-sufficient paystub producer that will not only assist in creating the correct pay stubs but also in filing a tax form such as W-2, W-9, and 1099. This makes it a one-stop solution to small businesses, accountants, and freelancers who may need both the payroll and tax-related documentation in one location. The 123PayStubs is easy to use and accessible anywhere and everywhere via mobile applications, making it able to produce stubs anytime and anywhere.

The other strength is that the platform is dedicated to the IRS regulations and the state frameworks. It automatically determines federal, state, and local taxes, and therefore, the net pay figures are precise. The platform does not have many pay frequency options and customization features, which is why it is applicable to any size of business.

Top Features:

- Create stubs + file W-2, 1099, and W-9 forms

- IRS and state tax compliance

- Mobile-friendly platform

- Multiple pay frequencies supported

- Secure, fast, and accurate calculations

Website: https://www.123paystubs.com/

Pricing:

- $3.99/stub

7. PayStubHero

PayStubHero is a fast and reliable online paystub generator designed to help employees, freelancers, and small business owners create professional stubs in just a few minutes. The platform is known for its easy-to-navigate interface, where users simply fill in employer and employee details, earnings, deductions, and pay frequency. Once the details are added, PayStubHero automatically calculates gross pay, taxes, and net pay, ensuring accuracy with every stub generated. It’s especially helpful for people who need quick income proof for things like rental applications, bank loans, or personal recordkeeping.

One of PayStubHero’s standout advantages is its emphasis on speed and customization. The tool allows you to instantly download professional PDF stubs that are neatly formatted and customizable with company logos. It also supports multiple pay schedules such as weekly, bi-weekly, and monthly, making it versatile for different business needs. With affordable pricing and secure encryption to protect sensitive information, PayStubHero is a practical choice for anyone needing quick and compliant payroll documentation without the hassle of traditional systems.

Top Features:

- Simple and user-friendly paystub generation process.

- Automatic calculations for gross pay, deductions, and net pay.

- Multiple pay frequency options supported.

- Instant PDF download with customizable templates.

- Secure data encryption for privacy protection.

Website: https://www.paystubhero.com/

Pricing:

- $7.90/stub

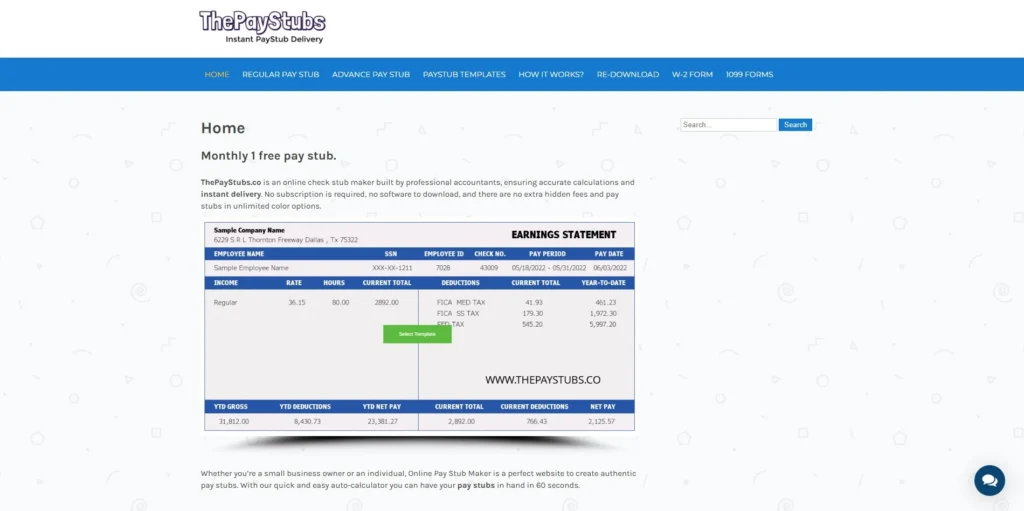

8. PayStubs

PayStubs is one of the most popular online paystub generators due to its accuracy and speed. It’s trusted by thousands of small business owners and independent workers across the U.S. The platform provides easy-to-use tools that calculate all deductions, including federal and state taxes, Medicare, and Social Security, ensuring compliance with tax laws.

What makes ThePayStubs stand out is its sleek and professional templates that are widely accepted by financial institutions. The website also provides excellent customer support, which is useful if users face issues during stub creation. Its secure system ensures sensitive financial data remains safe.

Top Features:

- Accurate federal and state tax calculations

- Professional-grade templates

- IRS-compliant pay stubs

- Excellent customer support

- Secure encryption system

Website: https://www.thepaystubs.co/online-pay-stub-generator/

Pricing :

- Free

9. FormPros Paystub Generator

FormPros is a versatile platform that offers a wide range of business forms, including pay stubs, invoices, and contracts. Its paystub generator is known for its simplicity, speed, and high-quality templates. The system handles all tax calculations automatically, which ensures error-free stubs that are ready for submission to banks, landlords, or employers.

Another benefit of FormPros is its affordability and flexibility. It allows unlimited access to multiple business forms, making it an excellent choice for small businesses and independent professionals. The platform also emphasizes security with encrypted transactions, ensuring your sensitive data is protected.

Top Features:

- Wide range of business forms (pay stubs, invoices, etc.)

- Automated tax and deduction calculations

- Professional, customizable templates

- Affordable and flexible plans

- Secure encryption system

Website: https://www.formpros.com/forms/create-paystub/

Pricing:

- $8.99/stub

10. StubCheck

StubCheck is an advanced paystub generator that assists individuals, contractors, or businesses in creating precise and well-designed pay stubs in a few minutes. The platform is crafted to ensure that payroll documentation is easy and stress-free, even when the accountant has little or no accounting knowledge. When you enter simple information like the name of the employer, employee, salary, and other deductions, StubCheck will automatically calculate net pay, taxes, and gross pay. The outcome is a neat, formal pay bill, which can be referred to as the official evidence of income with banks, landlords, or any governmental taxes.

What is most attractive about StubCheck is its emphasis on customization and accessibility. The user is able to customize their stubs by selecting various templates, inserting company logos, and selecting various pay schedules that suit them well. It also encourages various payment rates such as weekly, bi-weekly, semi-monthly, and monthly payments, and is therefore applicable to any type of employer and employee. It also has instant PDF downloads and has secured data handling that offers the safety of your financial information. StubCheck is a brilliant choice when it comes to getting a quick, customizable, and safe solution.

Top Features:

- Quick and accurate paystub generation with automatic tax calculations.

- Multiple pay schedules supported (weekly, bi-weekly, monthly, etc.).

- Customizable templates with logo integration.

- Professional, print-ready PDF downloads.

- Secure encryption to protect personal data.

Website: https://www.stubcheck.com/regular-pay-stub

Pricing:

- $3.99/stub

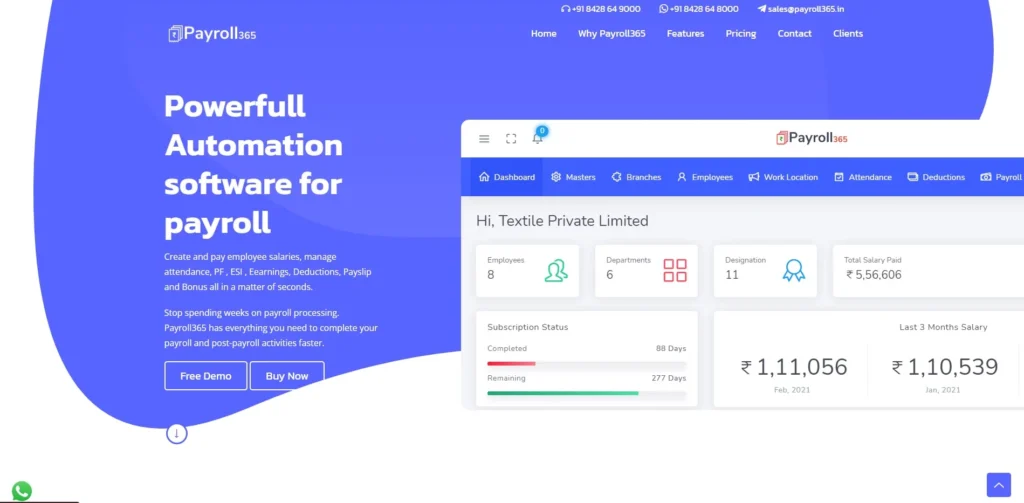

11. Payroll 365

Payroll 365 is a fast and reliable online paystub generator that caters to small business owners, freelancers, and contractors. It is designed to simplify the process of creating professional pay stubs by offering pre-formatted templates that are both neat and compliant with IRS standards. The platform calculates all taxes and deductions automatically, helping users avoid errors and saving them time.

The service is also known for its affordability and ease of use. Along with paystub generation, it also functions as a basic HR management system, allowing businesses to handle payroll tasks more efficiently. Users can generate multiple stubs with different pay frequencies, such as weekly, bi-weekly, or monthly, depending on their needs. Additionally, the platform ensures all stubs are accepted by banks and landlords, making it an ideal choice for anyone who needs income verification quickly.

Top Features:

- Automatic deduction and tax calculations

- Multiple pay frequency options

- Professionally formatted stubs

- Affordable pricing

- Bank and landlord acceptance

Website: https://www.payroll365.in/

Pricing:

- Available on request

12. OnlinePaystub

OnlinePaystub is a professional paystub generator built for businesses and individuals who want quick and secure payroll documentation. The platform stands out for its ability to create multiple stubs in bulk, making it ideal for small businesses managing several employees. With its easy step-by-step process, users can generate accurate and IRS-compliant pay stubs in just a few minutes.

What makes OnlinePaystub reliable is its detailed customization options. Users can select templates, adjust deductions, and add company logos to make the stubs look even more professional. The platform also ensures high data security, giving users confidence that their information is well-protected.

Top Features:

- Bulk stub generation for multiple employees

- Customizable templates with logo options

- IRS-compliant documentation

- Fast and accurate processing

- Secure encryption technology

Website: https://online-paystub.com/

Pricing:

- $3.99/stub

13. PayStubGenerator

PayStubGenerator is a simple and convenient online service platform that assists people and small enterprises in producing income documentation effortlessly. It also provides a fast installation in which the user only has to key in company details, employee details, and pay structure. All calculations of taxes and deductions are then done on the platform so that the stub is correct and legal.

Payment is one of the greatest advantages of PayStubGenerator because they are cheap and easy to use. It also serves small employers, contractors, and freelancers who are not required to use complex payroll software but still need to have professional stubs. Banks, lenderss and landlords are very accepting of the generated documents and thus can be considered as credible evidence of income.

Top Features:

- Automatic tax and deduction calculation

- Simple, user-friendly interface

- Affordable and fast solution

- IRS-accepted stubs

- Secure and encrypted platform

Website: https://www.thepaystubs.com/

Pricing:

- $5.99/stub

14. Paystub.org

Paystub.org is a versatile and efficient online solution for generating pay stubs, W-2 forms, and 1099-MISC documents. Designed with freelancers, small businesses, entrepreneurs, and employees in mind, this platform helps streamline payroll-related documentation in a simple three-step process. Starting with selecting a template, you fill in relevant information and download your document—all within minutes. The tool is trusted for its accuracy and reliability, making it easy to stay on top of tax filings and income documentation.

Security and trust are important pillars of Paystub.org’s design. It uses up-to-date tax settings and ensures user data remains protected throughout the generation process. The service is particularly helpful for self-employed individuals who need proof of income quickly, whether it’s for loan applications or tax submissions.

Top Features:

- Generates pay stubs, W-2s, and 1099-MISC forms in one place

- Easy 3-step process: choose template, fill in details, preview & download

- Reliable and accurate tax data

- Secure generation and download process

- Tailored for freelancers, employees, and businesses

Website: http://paystub.org

Pricing:

| Monthly | Annual |

| $27.88/mo | $89/yr |

15. Wave Pay Stub Generator

Wave’s free pay stub generator is a straightforward tool designed for small business owners, freelancers, and contractors who need to create professional pay stubs without the complexity of full payroll software. With Wave, users can generate pay stubs by entering essential information such as company details, employee information, earnings, and deductions. The platform then automatically calculates the necessary totals and generates a clean, professional pay stub that can be downloaded or emailed directly to the employee.

One of the key advantages of Wave’s pay stub generator is its simplicity and accessibility. There’s no need for subscriptions or software downloads; users can access the tool directly through their web browser. This makes it an ideal solution for individuals and small businesses looking for a quick and easy way to create pay stubs without the overhead of more complex payroll systems.

Top Features:

- Free to use with no hidden fees.

- Simple and intuitive interface.

- Automatic calculations for earnings and deductions.

- Ability to download or email pay stubs directly.

- No software installation required; web-based access.

Website: https://www.waveapps.com/

Pricing:

| Standard | Pro |

| $0 | $190/yr |

Comparison

| Software | Key Features | Website | Pricing |

| PayStubCreator | State & federal tax compliance, instant PDF, deductions, customizable templates, secure platform | PayStubCreator | On request |

| Real Check Stubs | Multiple pay frequencies, free preview, mobile-friendly, customizable templates, IRS-accepted | Real Check Stubs | $8.99 |

| PayStubs.net | Automatic tax calculations, professional templates, support, financial acceptance, and reliable processing | PayStubs.net | Free |

| Check Stub Maker | IRS-compliant, multiple stub generation, customizable, secure, fast & easy | Check Stub Maker | Free |

| StubCreator | Easy-to-use, multiple pay periods, customizable logos/templates, affordable, encrypted security | StubCreator | $4.99/mo |

| 123PayStubs | Paystubs + W-2/1099/W-9 forms, IRS compliance, mobile, multiple pay frequencies, secure | 123PayStubs | $3.99/stub |

| PayStubHero | Simple UI, automatic pay calculations, multiple pay schedules, instant PDF, encrypted data | PayStubHero | $7.90/stub |

| ThePayStubs | Accurate tax compliance, sleek templates, IRS-compliant, strong support, and encrypted | ThePayStubs | Free |

| FormPros Paystub Generator | Business forms + paystubs, auto calculations, customizable templates, affordable, secure | FormPros | $8.99/stub |

| StubCheck | Quick tax calculations, multiple pay schedules, customizable templates, instant PDFs, and encrypted | StubCheck | $3.99/stub |

| PayRoll 365 | Automatic deductions, multiple pay frequencies, professional stubs, affordable, accepted by banks | PayRoll 365 | On request |

| OnlinePaystub | Bulk stub generation, customizable templates, IRS-compliant, secure & fast | OnlinePaystub | $3.99/stub |

| PayStubGenerator | Auto tax calculations, simple UI, affordable, IRS-accepted, secure platform | PayStubGenerator | $5.99/stub |

| Paystub.org | Paystubs + W-2/1099-MISC, simple 3-step, reliable, secure, freelancer-friendly | Paystub.org | $27.88/mo or $89/yr |

| Wave Pay Stub Generator | Free, simple UI, auto calculations, download/email, no install required | Wave | Free; Pro $190/yr |

Conclusion

In conclusion, Paystub generators have made income documentation simple, fast, and reliable. With just a few clicks, these tools handle all of the tax, deduction, and salary calculations for you, saving you hours of work. Paystub generators provide you with immediate access to accurate, professional, and commonly accepted pay stubs, whether you’re a small business owner handling employee payments, a freelancer attempting to verify your income, or an individual seeking a loan or rental. With so many choices, you may select the one that best meets your requirements and produce stubs with assurance and ease.

FAQs

Are pay stubs created online legally valid?

Yes, as long as the information you provide is accurate and the tool follows proper tax rules, online pay stubs are considered valid proof of income by banks, landlords, and financial institutions.

Who can use a paystub generator?

Anyone can use it—freelancers, contractors, small business owners, or employees. It’s especially useful for people who need quick income proof without complicated payroll systems.

Do I need accounting knowledge to use a paystub generator?

No, most platforms are designed with simple forms where you just enter details like company name, employee name, salary, and deductions. The system handles all calculations for you.