Binance has long dominated as a go-to platform for spot, futures, and margin trading. However, with ongoing regulatory pressures, high fees in certain regions, and occasional downtime concerns, many crypto traders are looking for reliable alternatives.

The good news is that several crypto apps fit different needs, from self-custody wallets built for Bitcoin’s new ecosystems to regulated exchanges with deep liquidity and transparent audits. Read on to learn more about five reputable Binance alternatives and who they’re best for.

TL;DR

- With Binance facing regional restrictions and higher regulatory pressure, many users are exploring alternative platforms for crypto trading and investing.

- The crypto ecosystem offers both regulated exchanges and decentralized self-custody solutions.

- Each platform varies in security, liquidity, and usability, making it essential to align your choice with your personal risk profile and trading goals.

- Regardless of the platform, maintaining transparency and access to your own assets should remain your top priority.

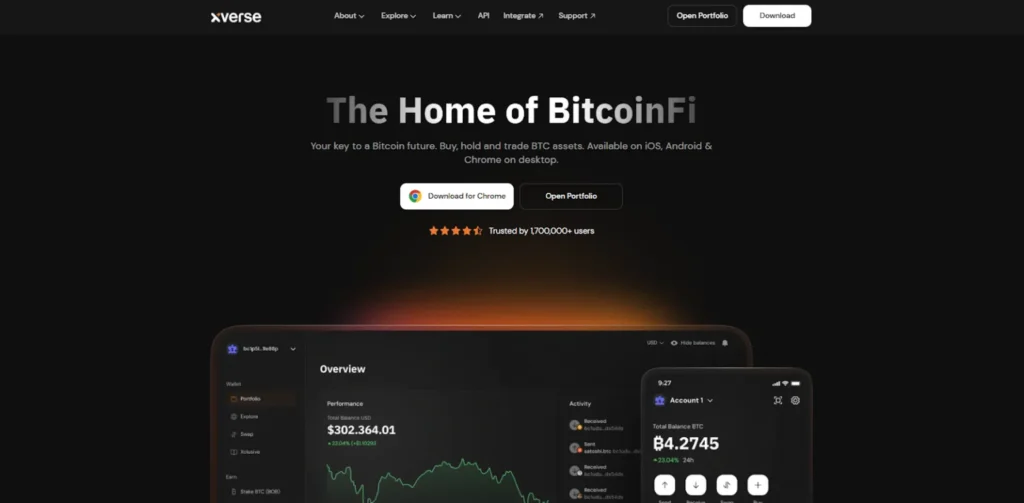

1. Xverse

Xverse stands out as a non-custodial Bitcoin wallet and web-based platform, redefining alternatives to centralized giants like Binance by putting users in complete control.

It enables easy token management and trading in a unified view, with quick setup under two minutes, focusing on the Bitcoin ecosystem.

Xverse goes beyond simple Bitcoin storage and trading. It’s designed as a gateway to the expanding BitcoinFi economy. The wallet natively supports Bitcoin (BTC) and on-chain Bitcoin assets like Ordinals and Runes as well as a wide range of Bitcoin Layer 2s, including Stacks, Starknet, Mezo, and Spark.

Key Features

- Supported assets: BTC, Ordinals, Runes, and L2 tokens from Stacks (STX), Starknet, Mezo, and Spark.

- Trading types: In-wallet swaps and bridges via smart-routing aggregator; Lightning Network for fast transfers.

- Self-custody: On-device key encryption & hardware wallet compatibility (Ledger, Keystone).

- Earning options: On-chain staking and liquidity yields for BTC and STX through vetted protocols.

- Mobile and cross-platform access: Full support on iOS, Android, Chrome, Brave, and Arc browsers.

- dApp/DeFi integrations: Connections to Bitcoin DeFi apps on Stacks, Starknet, and Spark ecosystems.

Security & Compliance

Private keys never leave the user’s device, ensuring complete self-custody. Xverse encrypts all data locally and undergoes independent audits. No personal information is collected, aligning with privacy-first principles and decentralized operation.

Fees & Costs

Xverse is free to download and use. Users pay only customizable Bitcoin network fees with no added platform or service charges.

Best For: Bitcoin users who want self-custody, access to DeFi, and full ownership of their keys.

2. Kraken

Kraken is a custodial cryptocurrency exchange that offers trading, staking, and OTC services alongside spot, margin, and futures trading options in a high-liquidity environment.

It is suitable for both individual and professional clients seeking a broad crypto asset portfolio combined with advanced trading capabilities.

Key Features

- Supported Assets: 543 cryptocurrencies; U.S. users access 11,000+ stocks and ETFs.

- Trading Types: Spot, margin (up to 10x leverage), and 100+ futures contracts.

- Self-Custody/Wallet Options: Custodial exchange storage; API for custom integrations.

- Earning Options: Opt-In Staking with weekly rewards.

- Mobile and Cross-Platform Access: Dedicated app for advanced orders and on-the-go trading.

- dApp/DeFi Integrations: API support for external tools; no native DeFi wallet.

Security & Compliance

Kraken stores most user funds in offline cold wallets and conducts third-party audits. The company is regulated in the U.S., U.K., and EU, and it has published transparency and risk-disclosure statements.

Fees & Costs

Kraken’s trading fees start at 0.16% (maker) and 0.26% (taker), with volume-based discounts for active traders.

Best for: Users seeking a regulated, secure exchange with reliable fiat gateways.

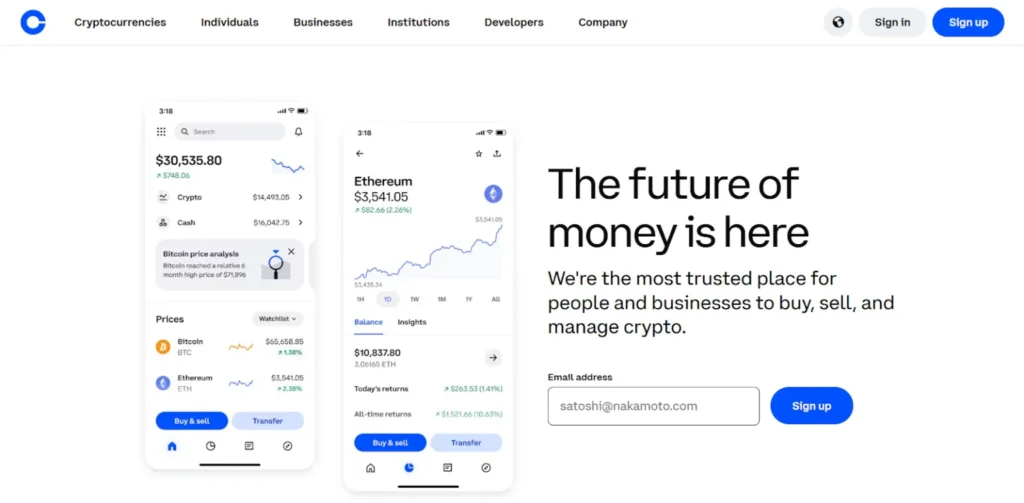

3. Coinbase

Coinbase is a beginner-friendly exchange, combining intuitive design with broad asset coverage. It offers a simple buy/sell interface plus the Advanced Trade platform for professional traders.

Key Features

- Supported assets: Hundreds of cryptocurrencies, including BTC, ETH, and DOGE.

- Trading types: Spot buys/sells; Advanced Trade with order books and charting.

- Wallet options: Separate Coinbase Wallet for DeFi and NFT storage.

- Earning options: Up to $2,000 sign-up crypto; boosted rewards via Coinbase One.

- Mobile and cross-platform access: App for trading and wallet management.

- dApp/DeFi integrations: Wallet enables DEX interactions and NFT trades on the Base chain.

Security and Compliance

As a publicly listed U.S. company, Coinbase operates under strict regulatory oversight. It keeps the majority of assets in cold storage and ensures custodial funds against breaches.

Fees & Costs

Trading fees range from 0.05% to 0.60%, depending on volume. Coinbase One members enjoy fee-free trading for a flat monthly rate.

Best for: First-time buyers and retail users who prioritize simplicity and compliance.

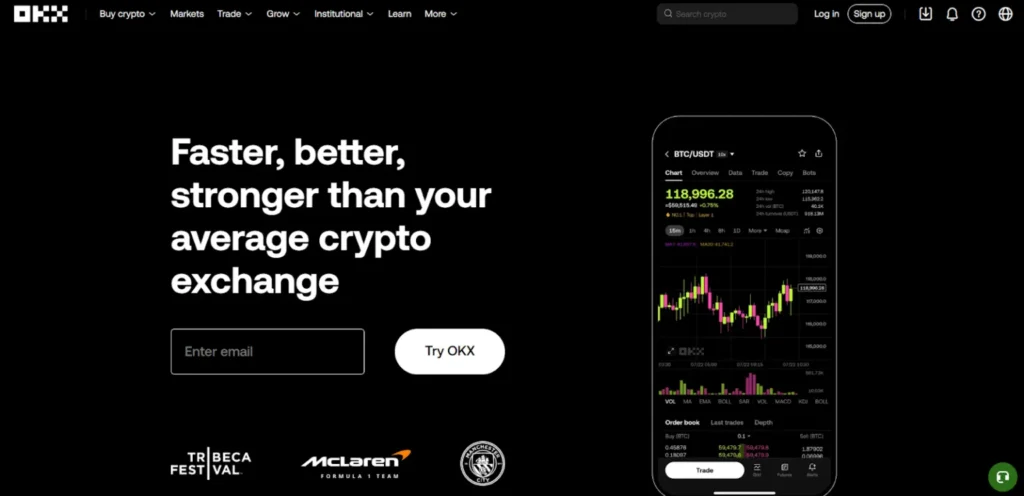

4. OKX

OKX combines a centralized exchange with a Web3 wallet, giving users a hybrid experience. It supports spot, futures, and options trading while connecting to dApps and DeFi protocols across multiple chains.

Key Features

- Supported Assets: Broad range, including recent additions like $MET and PAXG.

- Trading Types: Spot, futures, perps, and options; Recurring Buy for DCA.

- Self-Custody/Wallet Options: OKX Wallet for DeFi and NFT management.

- Earning Options: Yields on deposits (e.g., 4.1% APY on USDG with bonuses).

- Mobile and Cross-Platform Access: App for trading, swaps, and HODLing.

- dApp/DeFi Integrations: Multi-chain perps and dApp connections.

Security & Compliance

OKX maintains the majority of user funds in cold storage and publishes periodic PoR audits. The platform adapts features to meet jurisdictional requirements, ensuring compliance in major markets.

Fees & Costs

OKX uses a tiered fee model starting at 0.08% (maker) and 0.10% (taker). Users staking OKB tokens receive additional discounts.

Best for: Experienced traders who want both CEX liquidity and Web3 functionality.

5. Bitstamp

Founded in 2011 and acquired by Robinhood in 2024, Bitstamp remains one of the most trusted exchanges for European investors. It focuses on straightforward trading and regulatory compliance, making it ideal for conservative investors.

Key Features

- Supported assets: Core pairs like BTC, ETH, TON; full list on-site.

- Trading types: Spot trading across extensive pairs.

- Self-custody/Wallet options: Custodial platform storage.

- Earning options: Learn & Earn quizzes for asset rewards (e.g., TRUF).

- Mobile and cross-platform access: App for quick market access.

- dApp/DeFi integrations: Limited; focuses on exchange basics.

Security & Compliance

Bitstamp operates under EU and U.K. regulatory frameworks, employing cold storage and anti-phishing tools. It has maintained a spotless operational record for over a decade.

Fees & Costs

Tiered trading fees start at 0.30% and decrease with higher volume. No hidden surcharges or maker/taker confusion.

Best for: Investors who want a long-standing, no-frills exchange with regulatory oversight.

Which Binance Alternative Is the Best?

There’s no one-size-fits-all alternative to Binance. The right choice depends on what you value most, whether it’s regulation and fiat access, advanced trading infrastructure, or ownership and privacy.

Still, as exchanges continue to adapt to stricter compliance environments, keeping control of your private keys ensures that your assets remain accessible and secure, no matter what happens on third-party platforms.

Ultimately, the best approach might be a balanced one: using a regulated exchange for fiat transactions and liquidity, paired with a self-custody wallet for storing and managing your digital wealth.