The use of online shopping is quite widespread. You will be required to pay when you purchase a video game or shoe online. That section of the site that accepts your cash is referred to as a payment gateway.

Companies get to know that when they have a payment page that resembles their own brand, their customers would trust them more. This is where white-label payments are involved. There is a rapid increase in the market of this special service. By 2026, the market of white label payment gateways will reach more than 2.8 billion.

This is a section of an enormous 185 billion market known as embedded finance which signifies to enclose money instruments within other applications. The number of companies that accept payments through the help of other small businesses is approximately 25 percent of all white-label payment services used by these companies known as ISOs (Independent Sales Organizations) nowadays.

This paper will define a white label payment gateway and provide the 10 best companies that offer this service in 2026.

What is a White label payment gateway?

Imagine it is a simple, white T-shirt.

The T-shirt company produces a blank shirt. That garb of plain shirts is purchased by your local school band. The band then prints their logo on it and sells it to them at a concert. You buy it, and the T-shirt that you see is not that of the T-shirt factory but that of the band.

A white label processing solution is no different.

- A massive tech firm (the factory) provides a perfect, extremely safe payment system.

- You buy this system with your business (the “band”).

- It is your own logo, colors, and name.

When your customers visit to make a payment, they see the Your Store Pay page. The name of the tech company is never seen behind the scenes. Your business appears to be more professional, and the customer has a stronger trust in you since they do not have to leave your site.

How White-Label Payment Gateways Function

This may sound difficult, yet the customer finds the process easy.

- Checkout Time: Your customer completes the shopping process in your site and he clicks Pay Now.

- Your Page Appears: They are forwarded to a payment page. Your store logo, colors and name are on this page. It looks like you built it.

- Info Entered: The customer enters in the credit card number.

- The Secret Work: This info is taken by the white label gateway (working in the background). It encrypts it (scrambles it and makes it illegible to any other person).

- Bank Talk: This is sent to the bank via the gateway requesting it to say, “Does this individual have the money?

- The Response: The bank responds to the gateway with the message Yes or No. This takes about one second.

- All Done: You receive a message of payment successfully on the gateway to your customer.

- You Get Paid: You deposit the money to your business bank account.

The entire duration, the customer does not feel unsafe since he or she did not abandon your brand.

Core Benefits of White-Labeled Payment Solutions

Why would a business do this? There are big advantages.

- Grows Your Brand: The greatest advantage is this. The only logo that customers see is yours. It enhances the appearance of your business and makes it appear bigger and more professional.

- Builds Customer Confidence: Customers are jittery when a Pay button takes them to an unfamiliar site they are not familiar with. Having them on your branded page will make them feel more safe and will urge them to complete the purchase.

- Time and Money Saving: It is difficult to construct a payment gateway on your own. It may take years, millions of dollars and you have to adhere to thousands of security regulations (such as PCI compliance). It is more affordable and quicker to rent a white-label one.

- Sell in Days or Weeks Not Years: You can begin selling in days or weeks not years.

- You Can Make Money: There are gateways where you can charge what you want. When you are a platform (such as Shopify), you can provide payment facilities to your sellers and collect a small percentage on each sale they make.

White-Label Pricing Models of Payment Gateway.

The way you finance such services typically belongs to three categories:

1. SaaS License Fee (Flat Fee):

- What it is: You pay a certain amount of price on a monthly or annual basis, such as a Netflix subscription.

- Who it is targeted: Businesses who desire to know the specific amount of their bill every month.

2. Per-Transaction Fee (Pay-as-You-Go):

- What it is: You pay a small fee per single sale that you make. An example is that you could pay 10 cents per transaction.

- Who it is targeted at: It targets small businesses that are just beginning and who do not have many sales yet.

3. Revenue Share (Rev-Share):

- What it is: You and the white-label provider will divide the payment fees. The provider charges a minor percentage of the total sale amount.

- Who it is targeting at: Big platforms that have millions of dollars of transactions. When you get money, so does the provider.

A combination of these is used by most of the companies. As an example, they can offer a fixed monthly rate with a small transaction fee.

We suggest you to check this blog also Payment Gateways in India

Quick Overview of White Label Payment Gateway Provider Companies

| Provider | Based In | Best For | Pricing Model |

| Stripe Connect | USA & Ireland | Marketplaces, SaaS, multi-vendor platforms | Per active account + % on payouts |

| Adyen for Platforms | Netherlands | Large enterprises, global brands | Interchange++ |

| Braintree (PayPal) | USA | All-size businesses, subscription apps | Quote-based |

| Akurateco | Portugal | Firms needing payment orchestration | Tiered (SaaS or On-Premise) |

| Rapyd | UK | Global companies with diverse local payment needs | Interchange++ / Quote |

| Nuvei | Canada | Omnichannel businesses | Quote-based |

| PaySimple | USA | Service businesses (gyms, schools, invoicing firms) | Quote-based |

| NMI | USA | ISOs, banks, payment resellers | Quote-based |

| Authorize.Net (Visa) | USA | Small/medium e-commerce | $25/month + fees |

| Razorpay (India) | India | Indian businesses, UPI-based commerce | Quote-based |

Top 10 White Label Payment Gateway Providers (2026)

Here are ten of the best companies offering white-label payment solutions.

1. Stripe Connect

- Based in: South San Francisco, USA & Dublin, Ireland

- Best for: Marketplaces, online platforms and SaaS companies.

- The price: It charges you a fee per active account and a minimal percentage (such as 0.25) on the amount of money you withdraw.

Stripe is a powerful and the most popular payment company in the world. Their special product is Stripe Connect that is used by the platforms that should compensate other individuals. As an example, in case you create a site such as Airbnb, you must receive and distribute money to the travelers and the owners of the properties. This is all managed by Stripe connect.

It allows you to develop a payment system that is integrated directly into your application, much like a white label payment gateway setup where the payment flow appears fully under your brand. Your users (the sellers or owners) have a chance to register and be verified directly on your site. Stripe takes care of the hard security and legal background checks.

Features:

- Allows you to easily divide payments

- 135+ currencies

- Easy seller sign-up

- Very secure.

Why pick this one? It is highly powerful, and is trusted by millions of people with incredible developer tools.

- White-Label Use Case: A food delivery application is powered by Stripe Connect. Customers pay the app. The app is powered by Stripe and it automatically divides the payment, sending a portion of it to the restaurant, a portion to the delivery driver and a small portion to the app itself.

Link: www.stripe.com/connect

2. Adyen for Platforms

- Head office: Amsterdam, The Netherlands.

- Ideal to use: Large and international firms and enterprise level systems.

- The Price: An interchange++ model. This is very clear. You pay a little set amount (such as 0.10) and the precise amount charged by the bank.

Adyen is one of the biggest rivals of Stripe, and they specialise in large and global companies. Their Adyen for Platforms product is a fully white-label solution. It allows a platform to manage the whole payment process to the end. Adyen has direct access to all the major card networks (such as Visa and Mastercard) and as such, they will be able to provide you with better data and speed.

They are quite efficient in accepting payments made in any part of the world, in numerous local currencies and forms of payments (not only credit cards). They assist in registering your sellers and verifying them to ensure that you remain within the law.

Features:

- A one-stop online

- In-app

- In-person payments system

- Accepts numerous domestic payment options.

Why pick this one? You are a big, international company, which requires a single partner to do it all, all over.

- White-Label Case: A big hotel chain makes use of Adyen. To make a booking on their site, you make payment on their branded site. At the front desk, you check-in with the use of a card machine. The two payments are managed by Adyen and the hotel has everything under one roof.

Link: www.adyen.com/platforms

3. Braintree (A PayPal Service)

- Based in: Chicago, USA

- Ideal For: Companies both large and small, who desire the strength and reliability of PayPal.

- The Price: Their white-label partner program is normally quote-based. You need to negotiate with their sales force.

PayPal has purchased Braintree, which means that it has the strength of a giant, reputable organization. Braintree also has a white label payment gateway offering (also known as PayPal for Partners) where you can accept payments under your name. The greatest advantage is that it is easily linked to PayPal and Venmo.

It means that your customers will be able to use their credit card or PayPal or Venmo accounts to make payment, which will offer them a greater selection. Braintree offers a secure method of storing the card details of the customers (referred to as the Braintree Vault), that makes it simple to make a repeat purchase in a single tap.

Features:

- Immediately links to PayPal and Venmo

- powerful fraud prevention devices

- Recurring billing.

Why pick this one? You desire a white-labeled, custom page, and you do not want to miss out on providing a choice to customers to use PayPal.

- White-Label Use Case: An online subscription box service is a company that is using Braintree. The box service is also branded on the checkout page, and just above the credit card entry, the customer can look at a Pay with PayPal button.

Link: braintreepayments.com.

4. Akurateco

- Headquarters: Samora Correia, Portugal.

- Ideal For: Companies that require a payment orchestration platform.

- Price: Tiered. They also provide various plans (Starter, SaaS, On-Premise) depending on the requirements.

Akurateco is a bit different. They provide a white-label payment orchestration. This implies that they are able to link you with a large number of payment gateways simultaneously. Why is this useful? When the bank of one gateway fails, the Akurateco system will automatically redirect the payment to another operating gateway.

This is so that you do not miss a sale. You are able to purchase their software and operate it as your own. They provide a White-label SaaS (Software as a Service) model in which they operate it on your behalf, or an On-Premise model in which all the code is provided and you can operate it on your servers to have complete control.

Features:

- Smart payment routing

- Intelligent billing

- Robust risk management.

Why pick this one? You are a bigger business and you have to be linked with more than one bank and gateways simultaneously so that you would never miss a payment.

- White-Label Use Case: Akurateco is used by an international e-commerce store. When a Brazilian customer makes a payment, Akurateco forwards the payment to a Brazilian local bank. When a German customer makes a payment, it forwards the payment to a bank in Germany. This increases the chances of the payments to be passed.

Link: www.akurateco.com

5. Rapyd

- Based in: London, United Kingdom

- Best for: Companies that have to accept numerous various kinds of local payments.

- Price: Provides white-label solutions to its customers through an Interchange++ or Quote based model.

The primary ambition of Rapyd is to assist you in receiving payments in any part of the world regardless of how it happens. In most nations individuals do not use credit cards. They transfer money locally in bank, e-wallets or even cash vouchers. With the white label payment gateway offered by Rapyd, you can accept all of them. It also enables you to remit payments to over 190 countries.

You will be able to build a completely branded experience in either money collection or money payment. This works well with the gig-based economy platforms (such as Uber or DoorDash) that are required to compensate their employees across the globe in their local currency.

Features:

- Accepts more than 900 local payment options

- Payouts to 190 countries

- Inbuilt fraud-checking.

Why pick this one? Your company is highly international, and you have to receive money or give it to people in a great number of countries.

- White Label Use Case: Rapyd is used by an online video game marketplace. An Asian seller can receive payment in his or her local e-wallet. A Latin American customer can use a cash voucher that he or she purchased at a local shop. It is all on the brand of the marketplace.

Link: www.rapyd.net

6. Nuvei

- Based in: Montreal, Canada

- ideal for: Companies that conduct online and face-to-face sales (omnichannel).

- Price: “Quote‑based.” You need to call their sales department to get prices.

Nuvei is dedicated to all channels, that is, the omnichannel. They would like to tie your web site, your mobile application, and the cash register of your brick and mortar store into a single system. Their white-label solution will allow you to experience one, branded experience across the board. Another thing that Nuvei is associated with is the fact that it is open to new forms of payment, including cryptocurrencies.

They are able to assist you to accept over 600 local and alternative payment methods. Their platform provides you with one dashboard where you can view all your sales whether it occurred on your site or in your store.

Features:

- Real omnichannel (online and in-store)

- Accepts 150 currencies

- Accepts cryptocurrency.

Why pick this one? You have brick and mortar stores and an online presence and desire to have a single system to manage it all.

- White-Label Use Case: A major fashion brand is with Nuvei. You purchase a shirt on their branded site. You return it in the store. The store attendant swipes your receipt and the refund is done using the same Nuvei system, and all that happens in the name of the fashion brand.

Link: www.nuvei.com

7. PaySimple

- Based in: Denver, USA

- Ideal For: Small to medium size service businesses (such as gyms, schools or doctor offices).

- Price: “Quote‑based.” They develop a tailor-made plan depending on the size and requirements of your business.

PaySimple is designed to support businesses that offer services and not a simple product. The white label payment gateway is ideal to companies that have to send out invoices or recurring billing. As an example, a gym with a monthly fee or a lawn-care company that invoices after work.

The system of PaySimple can be branded to your company. It processes credit card payments as well as ACH (bank-to-bank) payments that tend to be cheaper. It is also excellent with franchise companies, in which the parent company desires to provide a branded payment tool to all of its stores in the area.

Features:

- Powerful recurrent billing

- Simple electronic invoicing

- Takes card and ACH

- Franchise friendly.

Why pick this one? Your business is a service and you have to bill the customers monthly or issue invoices.

- White-Label Use Case: PaySimple is used in a chain of dance studios. Each studio is provided with a branded payment page by the main company. Parents will have an option of creating an automatic monthly payment of classes at their local studio through their websites.

Link: www.paysimple.com

8. NMI

- Based in: Schaumburg, USA

- Ideal For: In independent sales organizations (ISOs) and other professionals who provide payment to small businesses, it is best.

- Price: “Quote‑based.” It is a reseller product on an enterprise level.

NMI is a “gateway’s gateway.” They do not normally sell directly to the small stores. They instead sell their white-label platform to other companies (such as ISOs or banks) who in turn sell it to the small stores. NMI provides you all the tools in case you are a company that desires to become a payment provider. They provide you a gateway to which you can stamp your logo.

They also allow you to sell online payments, in-person card readers and mobile payments. They allow you to build your own pricing strategies and control all of your customers (the small stores) using a single large dashboard.

Features:

- It has a “gateway emulator”

- which allows one to easily change other gateways

- Real white-label across all channels (online, in-store, mobile).

Why pick this one? You are a sales specialist and you desire to begin your own payment business and market to the merchants.

- White-Label Use Case: A local bank desires to provide a new service known as SuperPay to all its business clients. The bank acquires the white-label system of NMI and rebrands it as SuperPay and resells it to all the local stores and restaurants in town.

Link: www.nmi.com

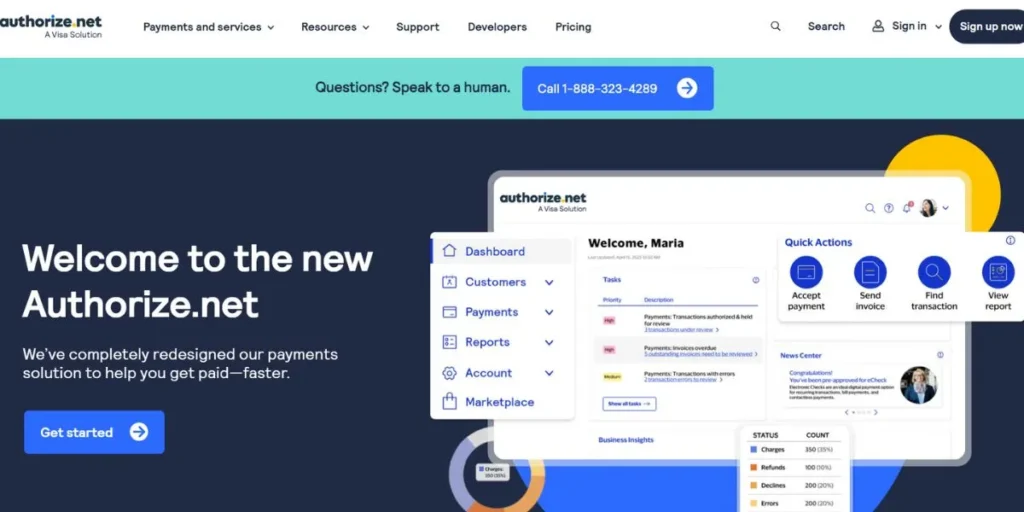

9. Authorize.Net (A Visa Solution)

- Based in: American Fork, USA

- Best for: Small to medium e-commerce stores that desire a trusted, easy to use solution.

- The price: Extremely transparent pricing. Their plan is an All-in-one at 25/month + fees and the Payment Gateway Only at 25/month provided that you already have a merchant account.

Authorize.Net is a payment gateway that has been in existence since time immemorial and is among the most reputable. It is now owned by Visa. Although the Authorize.Net branded page is utilized by many individuals, they also provide white label payment gateway features that allow you to place the payment form on your server, and the customer does not have to leave.

Due to its age, virtually all shopping carts and website builders (such as WooCommerce or Magento) have a pre-built plug-in to it. It is highly dependable, highly secure and possesses excellent tools to assist in combating fraud. It is a time-tested, reliable option.

Features:

- Fraud detection

- digital billing and a Customer Information Manager to keep payment information secure.

Why pick this one? You desire a highly reliable, safe, and famous gateway, which can be inserted in virtually any site system.

- White-Label Use Case: A medium-sized online hardware store uses Authorize.Net. They employ the tool of Accept.js that allows them to display the payment fields on their own checkout page. The customer simply types in her or his card number directly on the site of the store and Authorize.Net takes care of the security.

Link: www.authorize.net

10. Razorpay (for India)

- Based in: Bangalore, India

- Ideal for: Indian based business or those who would like to sell to the Indians.

- Price: Quote-based: their full white-label and platform solutions.

Razorpay is a pioneer in the Indian payment market which is rapidly expanding. They provide white-label solutions which are designed to address the distinct modes of payment in India. This encompasses the fact that they are experts in UPI (the most popular payment system in India), and all the local wallets (such as Paytm) and card networks.

Their RazorpayX product is white-label, and businesses can build their own branded financial products. This will allow you to automate payments, handle payroll and invoices, but all with your own brand and all under Indian laws.

Features:

- UPI and other Indian payment system experts.

- Brandable Payment Pages and Payment Links.

Why pick this one? Your company is business-oriented in India.

- White label Use Case: The white label option of Razorpay is used by an Indian online learning company (similar to Unacademy). When students purchase a course via UPI, the brand of the learning company will be visible to them. The same system can be used to pay the teachers of the company as well.

Link: www.razorpay.com

White Label Payment Gateway in India

The Indian payment world is developing at an extremely rapid pace. It is also highly unlike the rest of the world. A credit card is not the most popular means of paying in India. It is using UPI (Unified Payments Interface). This system allows individuals to transfer funds in their bank account immediately through their telephone.

Due to this reason, a white label processing solution in India has to be a specialist in UPI.

- Major Competitors: Leading companies include Razorpay, Paytm, and Instamojo.

- How it is Used: A great example is an Indian food delivery application, such as Zomato. Upon payment, you remain within the Zomato application. It can be paid in UPI or local wallet. It is a white-label, smooth experience. The payment is processed by the gateway in the background (such as Razorpay) but all you see is Zomato.

Conclusion

A white label payment gateway is an effective resource. It enables any company, large or small, to provide its clients with a secure and professional payment experience.

Instead of paying colossal amounts of money to invest in developing your own system, one can label an already developed, professional and safe system.

You can select a nice partner among the list and create customer trust, save funds and enhance your business image. It is just necessary to ensure insecurity, prices, and support.

FAQs

Is white-labeling safe?

Yes, it is safe. Stripe or Adyen is a security expert and will take care of encryption and PCI compliance on your behalf.

What is the difference between a white-label gateway and PayPal?

Under normal PayPal buttons, the customers will exit your site and proceed to PayPal to make a payment. When using a white-label gateway, they remain on your web site and view your logo on the payment page.

Is it applicable to big companies only?

No. A large number of providers such as PaySimple or Authorize.Net is suitable to small and medium-sized companies.

Is it expensive?

It is generally cheaper than assembling a system. You pay a little monthly charge or a little charge on each sale.